California Medicare Options - Compare UnitedHealthcare® versus Anthem medigap plans in California?

Comparing Anthem Blue Cross versus UnitedHealthcare® Medigap Plans in California

In many areas, this is the primary battle for Medicare supplements.

The big 3 in California are UnitedHealthcare®, Anthem, and Blue Shield.

Blue Shield led the way for people new to Medicare because they offered a $25/month discount for the first year (new to Medicare).

Now, UnitedHealthcare® and Anthem have matched this for the first year.

With an equal playing field, UnitedHealthcare® and Anthem now appear better priced in many areas so let's compare the two and see which way is best to go!

We'll cover these areas here:

- What's the same between UnitedHealthcare® and Anthem medigap plans

- Is UnitedHealthcare® or Anthem priced better for medigap

- How to compare your rates between UnitedHealthcare® and Anthem

- Switching and enrolling in either UnitedHealthcare® or Anthem

Let's get started.

What's the same between UnitedHealthcare® and Anthem medigap plans

We phrased it this way because so much is the same when you're dealing with medigap plans.

After all, they are standardized at the Federal level which means much of our comparison is pretty easy.

- Plan benefits are standardized - a G plan will match another G plan between

carriers

- Networks are the same - you can use any provider that accepts Medicare

nationwide

- Determination of benefits is the same - Medicare dictates what is covered ultimately

Once we decide on our plan level choice (see how to compare what medigap plans cover), it's then a question of two factors.

First, membership interaction is pretty comparable between UnitedHealthcare® and Anthem Blue Cross.

They're both pretty easy to deal with on the medigap side and keep in mind that prior interaction (through a company or Covered Ca, etc.) will be different.

Medigap or Medicare supplements is a completely different segment of the company.

The good news is that most of the heavy lifting is handled by Medicare. Medicare dictates if a provider is in the network and whether a claim is accepted.

The medigap carrier (UnitedHealthcare® or Anthem) just pays their share accordingly.

Again, from decades of dealing with the two carriers, we don't see much difference on a day-to-day basis in dealing with membership or customer service.

That brings us to the price.

This is really the big difference between carriers like UnitedHealthcare® and Anthem Blue Cross.

Let's go there now.

Is UnitedHealthcare® or Anthem priced better for medigap

Now that they both have the New to Medicare $25/month discount, it's become very competitive in the California medigap market.

Medigap rates are determined by area (zip code) and age. Within those two constraints, we can see carriers dominate pricing for given plans.

Let's take some examples.

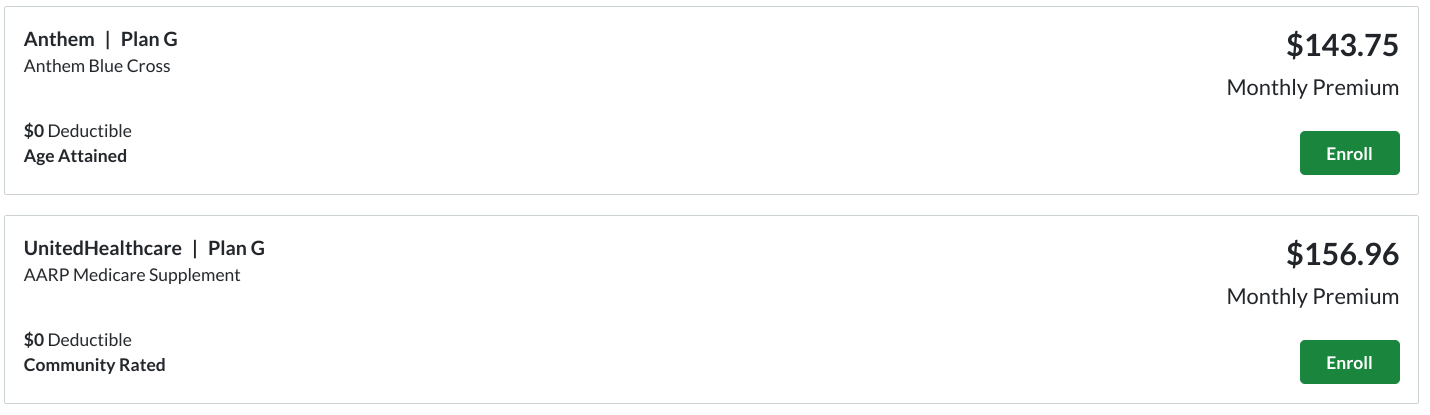

We'll look at age 65 in Los Angeles for the G plan (most popular) first:

This takes into account the $25/month discount.

So...at age 65, Anthem is priced best and that's been the case in greater Los Angeles for years now. Again, Shield would scoop up quite a bit of new Medicare enrollees because they had the 1st year discount.

Of course, this goes away and many people just end up staying on the more expensive plan but we'll touch on that below!

This is just an example in LA at age 65. Age 70 might be quite different and UnitedHealthcare® Health has been more aggressive with other plans like the K plan (see G versus K plan).

It's really important to run YOUR quote to get the full picture.

Let's go there now.

How to compare your rates between UnitedHealthcare® and Anthem

We make this easy.

You can run your UnitedHealthcare® versus Anthem medigap quote here:

UnitedHealthcare® may require a separate quote which we'll send you by email and if you just

want someone to do it all for you, send us your date of birth and zip code to

help@calhealth.net

We'll run the full market across the major plans for you and there's no cost for

our assistance!

More on us here:

Remember that the $25/month discount for UnitedHealthcare® or Anthem only applies to people

new to Medicare and for the first year.

After that, we want to quote the full rates but since they all have $25/discount, this makes it easier and Anthem or UnitedHealthcare® are generally priced in the top 3 with Shield.

Okay...let's say we find a best-priced option that works for us. Then what?

Switching and enrolling in either UnitedHealthcare® or Anthem

If you're newly enrolling, that's easy. Reach out to us at help@calhealth.net or go right through the quote.

If you want to switch plans, let us guide you through the process.

We can technically apply for a new medigap plan any time of the year. There's no "open enrollment" like with Advantage plans.

Once we're outside our open enrollment windows (usually getting a new Part B through Medicare), we may need to qualify based on health.

If that's an issue, we can use the Birthday rule to move within or between UnitedHealthcare® and Anthem Blue Cross regardless of health.

We're allowed to move to a plan of equal or lesser value...even between carriers.

So...we could go from a G plan with UnitedHealthcare® to a G plan with Anthem if the pricing is better.

That's why it's so important to price-check once a year and see where the market stands.

We even see lots of people still on the F plan with Anthem or UnitedHealthcare® and they could save roughly $500/year by moving to the G plan (more on switching from F to G plan).

This is found money and we love helping people find it!

Again, any questions are welcome. There's zero cost for our assistance as licensed California agents.