California Medicare Options - Alignment Health Most Popular Advantage Plans

What are Alignment's Most Popular Advantage Plans

We've already gone through why Alignment itself is so popular on the California advantage plan market at our Alignment Review and Comparison but let's dive further down.

Which of their plans real stand-outs?

In today's world, the top 2-3 plan with a carrier can account for the vast majority of their enrollment from our experience.

You can compare Alignment's plans in California but let's make this a popularity contest.

Here are the topics we'll cover:

- Why Alignment is competing among giants in California

- Alignment's Platinum+ Instacart plan

- SmartHMO Give Back plan

- Alignment Sutter plan

As for our credentials:

Let's get into it. One note...the plans available differ by area and Alignment has done an amazing job of crafting plans specific to the area.

This mirrors that health care is really a local consideration these days. Let's dive into it!

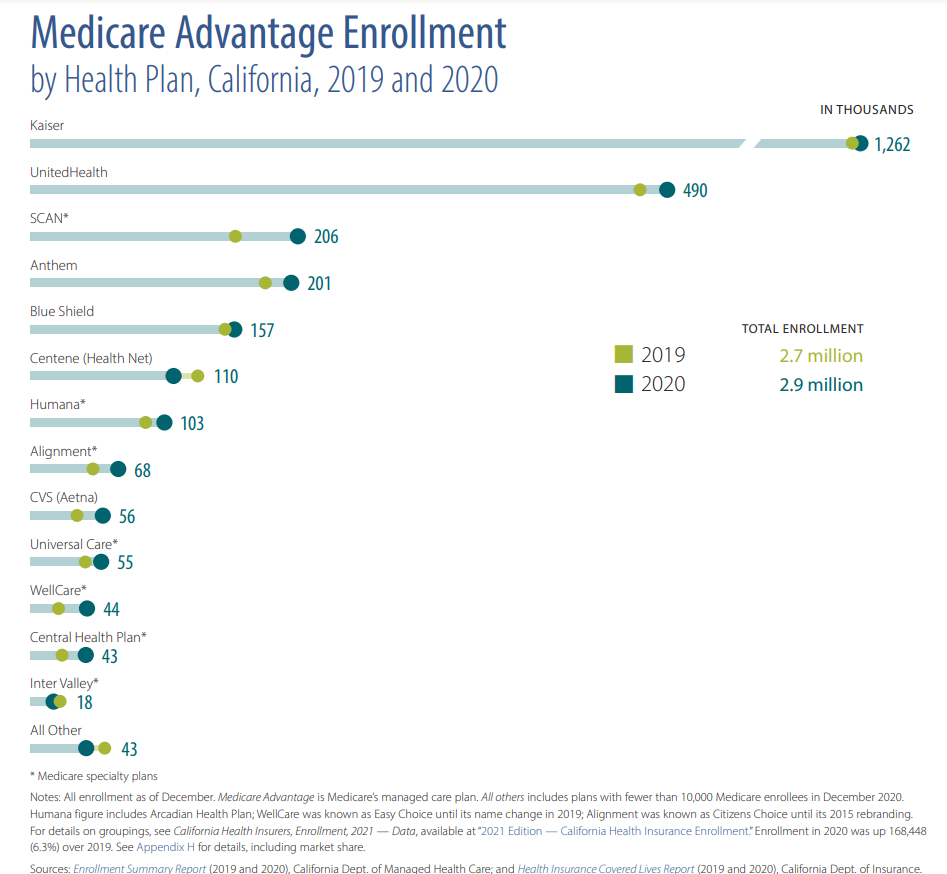

Why Alignment is competing among giants in California

Take a look at the pool that Alignment is swimming in:

Those are massive companies. Nationwide companies.

How is Alignment doing it?

Of all the Advantage carriers we've dealt with (we have 25+ years experience), Alignment has been the easiest to deal with!

Enrollees seem to agree as most of the plans they have boast a 4 Star Rating which is 1/3rd of our Triple Threat calculation.

The other two requirements:

- Max out of pocket

- Premium

We'll see how the max out of pocket comes into play in a big way below but the real drive of Alignment's popularity is...

Network!

We're not even sure how they pulled it off as a smaller carrier but they've managed to attract some of the biggest and best medical networks in both the south (greater Los Angeles) and north (Bay Area and out).

For example, Optum, Regal, and Heritage to name a few in Los Angeles. Huge coups!

In the North, Sutter and PAMF are highly sought after and they partnered with Alignment to team up for a plan specifically built around this massive network footprint.

Choice of doctors really drives the first decision in picking an Advantage plans.

Let's jump into the other criteria for some of Alignment's most popular plans across the State.

Keep in mind that if you qualify for extra help (medi-cal or LIS) or have a chronic illness, other plans may be more advisable.

Here's a quick comparison based on LA's market:

Let's look at some of these plans!

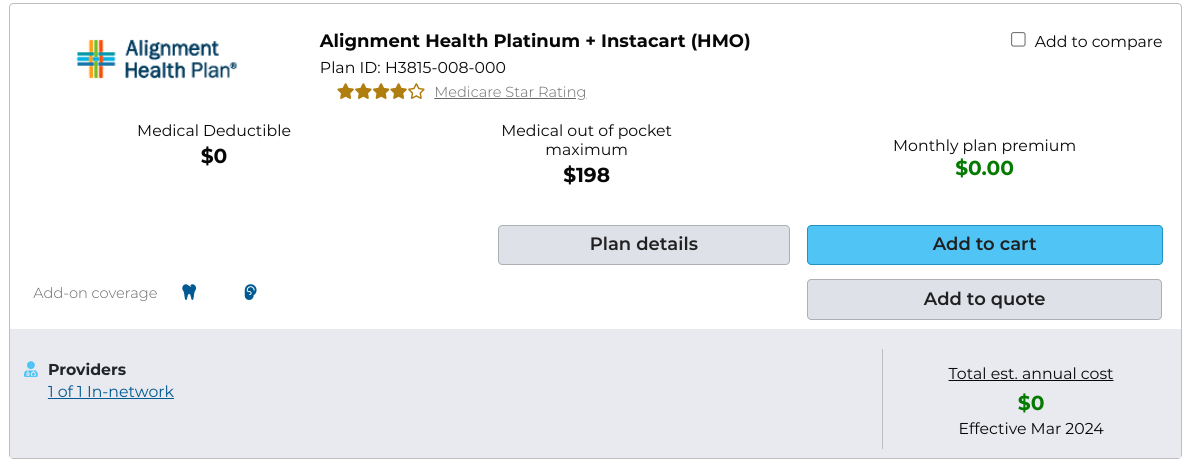

Alignment's Platinum+ Instacart plan

This is really the leader for Alignment across big areas, especially great Los Angeles.

Let's run a quick quote to look at this plan to figure out why.

Let's break it down.

- Zero deductible (pretty standard in LA)

- Zero premium (also common in LA)

- $198 out of pocket max

What!!?!?!?

This is fantastic. $800 is the standard low out-of-pocket max.

We looked in our Comparing Supplements and Advantage plans at why the out-of-pocket max is so important in this calculation.

It has the better Alignment network and an additional add-on.

Instacart!

Basically, if we qualify based on certain chronic illnesses, we can get grocery delivery up to $100/quarter.

We have a whole review on Alignment's Instacart benefit and plans for more detail.

When you run your quote below, this plan is generally the #1 plan across the carriers which is impressive.

Make sure to enter your doctors, medications/dosages and preferred pharmacy.

Let's turn to #2 runner up in a very popular category of Advantage plans.

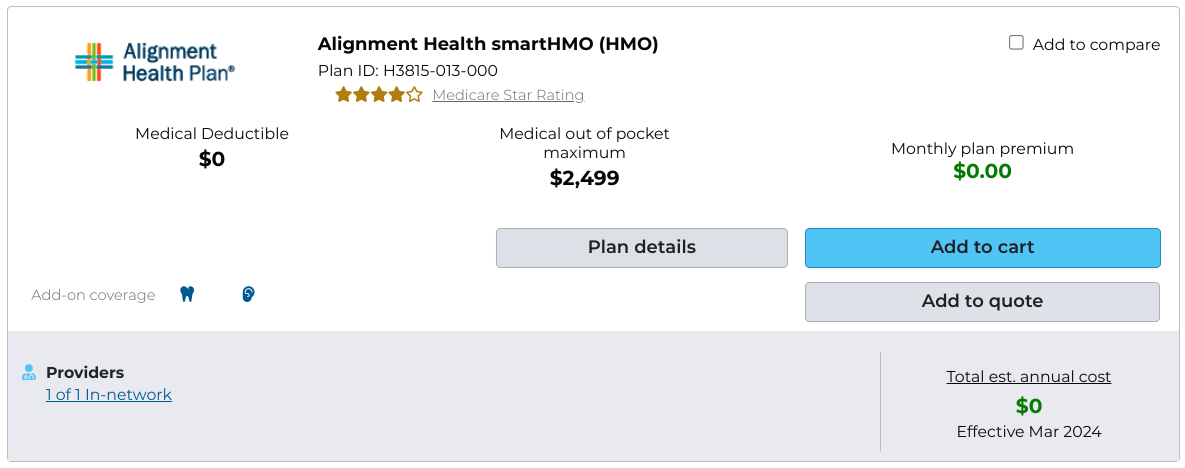

Alignment SmartHMO Give Back plan

First, a look from sample quote based on Los Angeles:

Where the Platinum+ plan stands on it core benefits and the grocery delivery add-on, the SmartHMO is part of a newer class of plans.

The Part B Give Back plans! We have a whole review on Part B rebate plans.

Essentially, this plan will offset up to $164/month of part B premium.

That's almost $2K per year and it pretty well offsets the out of pocket max of $2,499.

You can almost think of that max as being $499 roughly worst case if you're getting the full Part B give back benefit.

If you don't hit that max, it's found money and these days, this Part B give back benefit is a huge deal.

Let's say you hit $1K of your max (pretty big bills). That's roughly $1000 in your pocket (after you expenses) for the year or almost $100/month.

Deductible and premium are both zero by the way.

One important note...the SmartHMO plan is the one Alignment plan that has a smaller network.

It still has 4 Star rating so apparently the cash back benefit is outweighing the network limitations.

It may not have Optum, Heritage, and Regal among others so make sure to enter your doctors in the quote tool here:

Now, let's take a stroll up north.

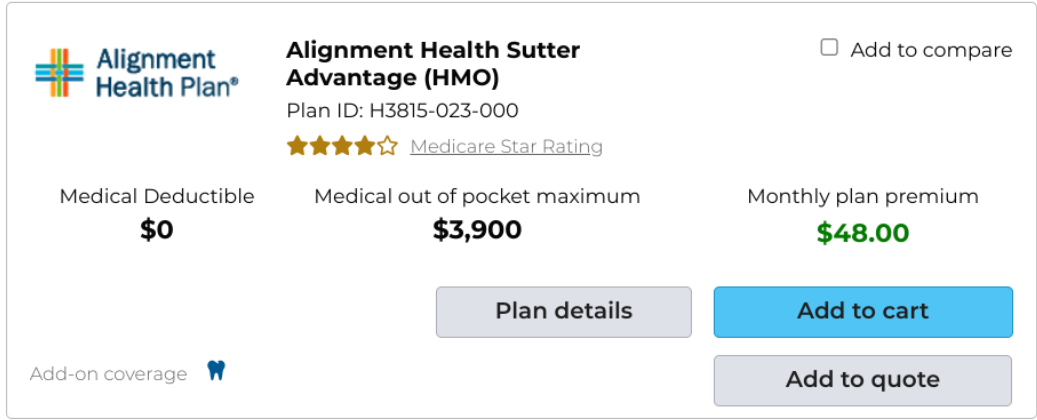

Alignment Sutter plan

One of the lead-in questions we get in the Bay Area...

"What Alignment plan can I use with Palo Alto Medical Foundation?"

A very similar enquiry is common with Sutter health from SF over to Sacramento.

Sutter is one of the dominant networks in the great Bay Area so this makes sense.

So...go figure:

As we mentioned in the first paragraph, Alignment will fine-tune plans specifically to an area. Sacramento is NOT Los Angeles!

The plans need to reflect this and Sutter worked with Alignment for a plan designed around this powerhouse network.

Sutter is literally in the name!

Expect to see these trends continuing as networks have more and more sway or power for attracting enrollees in the Advantage market.

The fact that Sutter worked with Alignment says quite a lot about Alignment's up-and-coming status in the State.

It's not called Aetna Sutter!

- Deductible is zero

- Premium is $48/month

- The max out of pocket is $3900

- 4 Star Rating (this speaks to the network satisfaction as well)

The max is higher than what you find in the Great LA area but pretty standard for Bay Area where max's run higher generally.

The real draw of course is the network in this case and benefits within the network.

Run your quote here to get the full detail:

A wrap on popular Alignment plans

Okay...we looked at three leaders for the up-and-coming carrier in the Advantage market.

Remember, every area will have different plans available. Run your quote with the following important guidelines:

- Add doctors under Preferences

- Add exact medications and dosages

- Add preferred pharmacy

- Sort by "Total Annual Estimated Cost" to get the most accurate quote

- Select "Show Special Needs Plans" up top if you qualify for medi-medi, LIS (additional help from State), or have a chronic illness.

Of course, there's zero cost for our assistance and you can book a time to chat here.

We're really excited about Alignment as is the market and apparently their enrollees (4 Star out of 5).

You can run your free quote and even enroll here: