California health insurance - California health carrier

comparison

California health insurance - California health carrier

comparisonAwesome! A California Health Carrier Comparison that Matters

So the good news is this:

The core benefits on the individual/family, small business (1-100 employees), and Medicare supplement markets are standardized now.

A Silver plan is a Silver plan (+/- 2%)

A G plan is a G plan

Great news.

Much easier to read and compare now.

But how do we compare the carriers themselves?

Yes, the monthly rate is different but that can't be all.

It isn't.

Most Californians come to the marketplace with only a vague inkling of how the carriers are different.

Maybe they had one before at a job.

Maybe a co-worker complained about one during coffee.

Perhaps, one paid for a hospital bill and it was all taken care of seamlessly.

We promise...it actually happens daily!

Unfortunately, the opposite also happens. Quite often.

Lots of anecdotal experience with carriers.

That's no way to make such a big purchase.

We agree.

We decided to take our 20+ experience dealing with all California health carriers and add in the available ratings for one total comparison package.

Keep in mind that the market is fluid. Networks, formularies, pricing, etc changing all the time.

Below is a snapshot in time.

You can access updated benefit, network, RX, and pricing information directly through the quote here:

Let's get started with our comparison to end all comparisons (we hope)!

Pick your Market Segment to Compare Health Carriers

First, understand that the California health insurance market is really 4 markets:

- Individual/Family Plans - (called IFP)

- Small Business (1 - 100 employees)

- Large Group (100+ employees)

- Senior - For Californians with Medicare (usually age 65 and over)

The different carriers will have comparative advantages depending on which market you are in.

That's a big deal.

So big that we broke up the comparison into the these markets.

You can jump to those sections from here (we won't be upset):

Individual/Family

Small Business

Large Business

Senior

The Important Attributes to Compare

So...what makes a carrier good or bad?

These are the key attributes we want to measure.

- Pricing

- Customer Service

- Networks

- Drug List

- Online Services

- Claims

We'll also add in their general status (size of network, number of enrollees, etc).

We'll further throw in NCQA ratings, Financial ratings, and various new customer satisfaction ratings.

Most importantly, we're going to give your our rating based on daily interaction with all facets of these carriers.

Why listen to us?

- We're licensed California health insurance agents and Certified Covered California agents.

- We've helped Californians choose, compare, and enroll in coverage for over 20 years.

- We have had ZERO complaints with the Department of Insurance while enrolling 10's of thousands of fellow Californians across all three markets.

- There is no fee for our services. That's right...our services are free to you. The rates are identical through us, the carrier, another agent, or online.

- Most importantly, we're not going to sugarcoat, obscure, or give the usual candied comparisons.

- We're going to rate according to our actual experience even if a carrier may not like it.

We'll leave it with this:

It's what we would expect on the other side.

Enough about us. Let's compare the carriers.

California Health Insurance Carrier Comparison - Total Market

Here are the key concerns when comparing plans in decreasing order:

- Pricing

- Network

- Customer Service

- Online Features

- Formulary

Let's look at each in detail to determine what's important to you.

Pricing

Look...the costs for health insurance have roughly tripled in the past 2-3 years.

That follows a decade of double-digit increases.

If you've been in the market, you know.

It's bad.

Pricing matters and we have to look at this piece first.

In the end, you have to be able to afford it!

A few key tips on the pricing side:

- Price is driven by age, zip code, plan level, and tax credits (if eligible)

- A given area and/or age may find different price leaders - no nationwide winner

- HMO's generally are cheaper than PPO, but not always (which we don't understand)

- Each family member is priced separately now.

- Your rates generally will not increase until Open Enrollment each year

- The new tax credit for Individual/Family is a huge deal (seriously)

Your area and age will make a big difference

Run your quote here by market segment to help you compare:

We'll list the key market differences to focus on in those respective (IFP, Business, Senior) comparisons below.

Carrier Network Comparison

This is becoming a bigger and bigger deal.

What doctors and/or hospitals does a carrier participate with?

How's is the HMO and PPO different?

Ever since 2014, we have separate networks now.

IMPORTANT: The new Individual/Family networks are smaller than the full Group network.

By about 1/3rd.

That's a big deal now so we need to understand that.

You can research provider networks by carrier through the quote below or access all the networks here.

One note...the online network systems for the carriers are not always user-friendly.

If there are doctors you want to check on, email us their names, cities, and which carriers you're interested in.

Some important concerns when comparing Carrier networks:

- HMO will always be smaller than PPO; about 2/3rds the size

- Kaiser is Kaiser....they own the facility and employ the doctors

- PPO's allow more flexibility both across and out of the State

- Always try to use in-network providers. Out of network will result in much higher out of pocket.

- For a true emergency (be conservative), you're generally not held to the network

- With EPO's, you have no benefits out of network (aside from true emergency)

- Networks can and do CHANGE. Always double-check before receiving services from the providers.

Provider networks didn't use to be a concern. All the major carriers had the same basic list of providers.

That's no longer the case...especially for Individual and Family.

We need to double-check if there are providers you want access to.

This now applies to hospitals and facilities as well.

We'll deal with the segment specifics of comparing networks in those sections.

Customer Service Comparison

Customer service isn't important...until it is!

Hopefully, you'll never have an issue but invariably, if there are changes or issues, you want to get it resolved without subsequently losing your F#*$#ing mind.

Sorry...just thinking of some interactions with carriers lately.

If you're in the middle of a health issue, the last thing you want to deal with is the DMV.

Truth be told...the DMV's come a long way.

Further than some carriers have!

We'll give you our true insight on dealing with the carriers.

Keep in mind that if we're your delegated agent, we handle a lot of issues on our side with just an email request.

Let us fight it out with the carriers!

Just a quick plug since our services are free to you.

Here's where we see Customer Service needs to be reviewed and compared:

- Claims processing

- Billing issues

- Account changes/updates

- Integration with Covered California (we'll explain in Individual/Family section)

- Doctor authorization

- RX authorizations

- Enrollment/Cancellations

Those are big ticket items we're reviewing for this comparison.

Any one of those can send you running into a pylon.

Let's avoid that.

Carrier Online Services Comparison

So there's this thing called the Internet.

But seriously, health insurance carriers aren't exactly on the cutting edge of technology.

They're finally coming around since they found out they can cut a few dollars here and there.

Never underestimate the power of cost cutting with a carrier!

The online account has the potential (somewhat reached depending on carrier) to really streamline your interaction with health benefits.

Think of your banking!

They're not quite there but getting closer.

Here are the key online services comparisons we consider:

- Access specific network of providers based on your plan

- Ease of use with billing changes, history, updates

- Claims visibility

- General ease of navigation and use

- Smart phone compatibility

Look, it's not the kiss of death.

We'll submit forms in triplicate if the plan is cheaper, works well, and has our doctor.

But we'd rather not!

Carrier Billing Comparison

Billing used to be non-issue.

Pretty easy and straight forward.

Not anymore. If there's a billing issue, the policy can cancel now and you may have to wait till Open Enrollment.

It can be a nightmare and it's one we get emails/calls on daily.

Let's look at the items we're comparing for carrier billing:

- Options available to pay

- Flexibility regarding billing issues

- Fees associated with billing options

- Customer service response on billing issues

- ummm...is it possible to actually read what the bill means (no kidding...especially on group side)

Each market segment is a little different but we'll address those in the Segment sections.

Carrier Formulary Comparison

This is another one of those that issues that didn't exist before.

This is another one of those that issues that didn't exist before.

The list of drugs that a carrier will cover...and at how much.

It's a huge issue now.

The carriers are panicking now to contain cost any way they can. The screws are being applied by the ACA law and there were two "gives".

Doctor reimbursement and drug payments.

The latter being a major driver of health care costs for last 15 years really.

Since 2014, we've seen the formularies shrink significantly.

Even some common drugs can be left off of certain carriers now.

Some carriers so heavily manage medications that you may see drugs subbed out during the year.

Here are the key issues to compare in regards to Drug Formulary:

- Breadth and depth of Formulary

- Ability to request authorization of doctor required medication

- Treatment of Brand name drugs

Again, if you have medications, this is suddenly a big deal.

Each segment really differs on the formulary comparison with IFP (Individual/Family) taking the biggest hit since 2014.

Now, onto the Carrier Comparison by market segment starting with Individual and Family!

Individual and Family Carrier Comparison

Below is the ranking by attribute for the Individual/Family market including Covered California.

The market has completely changed since 2014.

To make a good decision and comparison, we need to address some real key points.

Covered Ca and tax credit

We've written extensively about Covered Ca but a quick overview as it applies to the carriers.

Covered Ca is just a marketplace that administers the tax credit!

Your ultimate coverage is with one of the carriers above.

Covered Ca is not the carrier!

The claims, bills, networks, etc all reside at the carrier level.

This is an important distinction.

If we're eligible for a tax credit, it will apply evenly to ANY of the carriers.

Individual Family networks

The IFP market is where the networks have changed the most!

The new (since 2014) networks are about 2/3rds the size of the old Grandfathered networks or current full Employer networks.

That can be a big deal and we see big differences between carriers when we research the doctors for them.

IMPORTANT: If you are asking your doctor, ask them "What Covered Ca carriers do you participate with?"

You really need to say "Covered Ca" as part of the question for any plans since 2014.

Even the off-exchange plans use the same networks but the doctor offices all know "Covered Ca" as the brand.

You can also access the provider directories when your run your Individual Family health quote.

Feel free to email us with doctors names and cities for us to research as well.

Comparing Individual Family Formularies

Similar to the networks, the drug formularies have also changed.

They're much smaller now and there are more hurdles to jump over.

There's no way around that now on the Individual and Family market.

The formularies are also different from carrier to carrier. We're happy to investigate actual medications on how they're treated.

Keep in mind that formularies can change so it's best to get updated information.

Comparing IFP Plans and Pricing

The plans are standardized now. A Gold plan is a Gold plan regardless of the carrier.

The benefits can only differ by 2% up or down.

What about pricing?

You'll see rates all over the board depending on your area and age.

Running quotes all day long...we still don't see exact patterns.

Occasionally, HMO is cheaper than PPO. A carrier that's competitive in one area is more expensive than another.

The only way to run your Individual Family quote to compare the options.

Make sure to enter your income estimate for the current year plus your household number (number of people that file together on one 1040 tax form even if not enrolling).

The net net when comparing IFP plans?

Tax Credit. It really is the deciding factor regardless of carrier.

We can save you a ton of time with the calculation. Call us at 800-320-6269. Our services are free to you!

Small Business Carrier Comparison

First the comparison and then critical factors below:

This market segment has changed quite a bit since 2014 as well.

We've discuss the big changes to the group market from the ACA law but a few key carrier changes.

Small Business Definition

Small Business has gone from 2-50 to 1-100.

That's a big change...especially if your 50+.

From a carrier perspective, it's also re-shuffled competitiveness.

Cigna, Aetna, and others were big large group carriers under the old definition.

They had great pricing!

Depending on the area and demographics, that's not the case.

We're seeing some of the other carriers such as Health Net, Blue Shield of California, and CalChoice have much better pricing.

We're also seeing some of the regional HMO carriers like Western Health Advantage, Sutter, or Sharp priced really well by comparison.

You can run your Small Business quote across all major carriers to see who is priced better.

Many companies that were large group are being forced to change to Small Business.

That's the time to have us run the numbers across the market. It's a new ball game now.

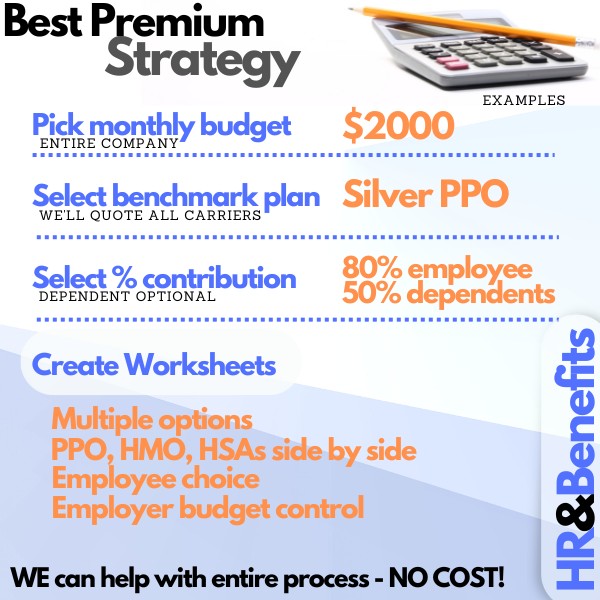

Small Business Carrier Networks

Many of the carriers have rolled out narrow networks....smaller versions of their full Group network.

This can be tricky.

The pricing is better but that doesn't help your employees if their doctor is off the list.

The better approach is to get the full network option and cap your employer contribution to a fixed dollar or fixed contribution of a given plan.

Otherwise, the Small Business carriers are pretty comparable and robust across the board.

You won't see much difference although there are a few that pop up now and then.

One reason people keep Employer based coverage versus Individual/family (including Covered Ca) is to keep their doctors.

The group networks are about 1/3rd bigger than individual/family.

Small Business Pricing Comparison

Right now, cost is king.

Employers are trying to find any way they can to contain the growing cost of benefits.

In that aim, we need to get creative.

First, Kaiser is generally priced really well. That's why they're so big. Of course there are trade offs (primarily network and RX restrictions).

CalChoice has become very popular on that front as well.

CalChoice is essentially a private exchange has offers other carriers at one stop.

There are situations where they can be cheaper for the same plan level than the carrier direct!

We'll always include CalChoice in the Small Business health quote to see how they stack up.

We're also looking at HSA's and HRA's to find relief from costs.

Certain carriers have plans better suited for these two options and we'll quote those as well to see if there's an angle for your particular group.

Request your Small business quote here. Our services are free to you as licensed health insurance agents.

Large Business

Large business health insurance is a world unto its own with separate rules altogether.

The pricing is generally level (not dependent on age or area) across the board.

Each carrier will essentially pre-underwrite the group based on size, age, health, etc to generate a rate for the company.

Cigna, Humana, and Aetna have been dominant large group carriers.

Their pricing tends to be best at this level (different from Small Business market 1-100 employees).

These days, the main issue is to avoid the new penalty for not offering coverage.

That has introduced MEC (Minimum Essential Coverage) plans, self-insuring, 3rd party wraps, etc.

The best approach is to submit your census and let us shop it out to all the large business carriers.

We'll quote to see if partial or full self-insuring might generate savings for the company.

The benefits and pricing for large group health is highly dependent on the demographics and health of the employees to be insured.

Request your large group health quote across all California carriers.

Carrier Comparison for Medicare Plans

The Medicare supplement market is interesting (as far as insurance goes).

We have a big review on Advantage plans versus Medicare Supplements. They're completely different markets!

The network is standardized. If the doctor/facility participates with Medicare, you're good!

The benefits are standardized. A G plan is a G plan.

So what's left?

Pricing and carrier stability.

Those two go hand in hand.

Keep in mind that your buying a policy that may last decades (all fingers crossed).

What's the point of getting cheap rate at 65 only to pay more from age 70+.

That's bad math.

Medicare supplement carrier pricing comparison

First, let's look at the pricing with an apples and apples approach.

You can quickly run your Senior quote here across major carriers.

Use the G plan as the benchmark since it's by far the most popular plan (and for good reason...more on Medicare Supplement guide).

Blue Shield of California and Health Net of California have both aggressively gone after the Medicare supplement market.

Blue Shield of California is the stronger carrier with the longer track record in Medicare Supplements so if the pricing is close, that's the better direction.

This leads us to price stability. This is a function of how stable you expect to the carrier's rates to be.

Basically, we want a carrier with:

- A long history of participation in the market

- A history of stable rate increase activity

- Pricing that's close to low/middle of the market

You also have to watch out for the age 65 discount!

In terms of stability, we like Blue Shield of California, Anthem Blue Cross, and others with the others to follow shortly behind.

You can compare the Medicare supplement quotes across all carriers here.

Carrier Comparison Ratings and Stats

We don't want to only give you our ratings based on 10's of 1000's of enrollment over 20 + years.

We want to give you other useful ratings that are out there:

NCQA Health Insurance Plan Ratings

State of California Patient Advocates Quality Report

Finally, health insurance is confusing to new buyers. Even old buyers!

You can access the online application here:

.jpg)

.jpg)

.jpg)