California Employer Health Options - Top 10 Tips to Save on

Employee Benefits

California Employer Health Options - Top 10 Tips to Save on

Employee Benefits

Top 10 Tips to Save on Employee Benefits

It shouldn't be more expensive than you actual labor, right?

Health benefits have skyrocketed over the past decade for small business and the trajectory is anything but reassuring:

There are ways to address this and we're go to shed light on our top

tips after 25+ years helping business of all sizes keep costs down while

still providing meaningful benefits.

First, our credentials:

Here are the insider tips we'll cover:

- Understanding who you need to cover

- Benchmarking the market

- Establishing the monthly budget and benchmark plan

- How to avoid the

double-coverage conundrum

- Annual check up for employee benefits

- Get

expert help who works with all the carriers

- The HSA option for employees

- Tax credits for small businesses - do they work?

- Save time and money with

Rippling

- Can a group pay for Individual Family plans

- Bonus: Employee gifts

1000's of California companies are overpaying for employee benefits

and they don't even know it.

Millions total going to the carriers. Stop burning money.

Let's get started!

Understanding who you need to cover

Establishing the monthly budget and benchmark plan

It's simple. We offer employee benefits to attract and keep the best employees which is money well spent (ever deal with a bad employee??).

There's a penny-wise and pound-foolish vibe to not offering employees health insurance especially in today's messed-up labor market.

So...what are the rules on who should be offered coverage.

Some of this comes down to the type of industry you're in. If it's very competitive, employees will demand benefits. But there's a catch.

These days, Covered Ca is a qualified exemption from needing to offer health insurance.

Meaning...if an employee wants to stay on their CoveredCa plan (because of tax credits), they can and it doesn't figure into our requirement.

That requirement is to offer coverage to 60-70% of ELIGIBLE employees.

Let''s see who isn't included in this pool - employees with:

- CoveredCa

- Medi-cal

- Medicare

- Part time (but you can choose to

offer to part-timers if you want)

- Other employer coverage (say through

spouse)

- Within initial hire window or full-time status window (up to 90 days)

The Covered Ca and part-timers make up the bulk of those who will either opt-out (Covered Ca) or not need to be included (part-timers).

Part-time is under 30 hours (prior calendar quarter generally).

There's a wrinkle on the CoveredCa piece which we'll cover below in the monthly budget section.

You can choose to offer coverage or premium help for dependents or not. It's up to you.

Now we know who we need to offer coverage to. We can help with specific questions or tips on how to reduce your cost but cover your key employees.

Understand that many of your CoveredCa employees with tax credits will probably keep their coverage and not enroll.

That can reduce your cost significantly (maybe 1/2!!) depending on income levels but we have to structure it correctly! Again, more in the budget section.

Let's get into the nitty gritty.

Benchmarking the market

We run quotes for thousands of companies every year here:

.jpg)

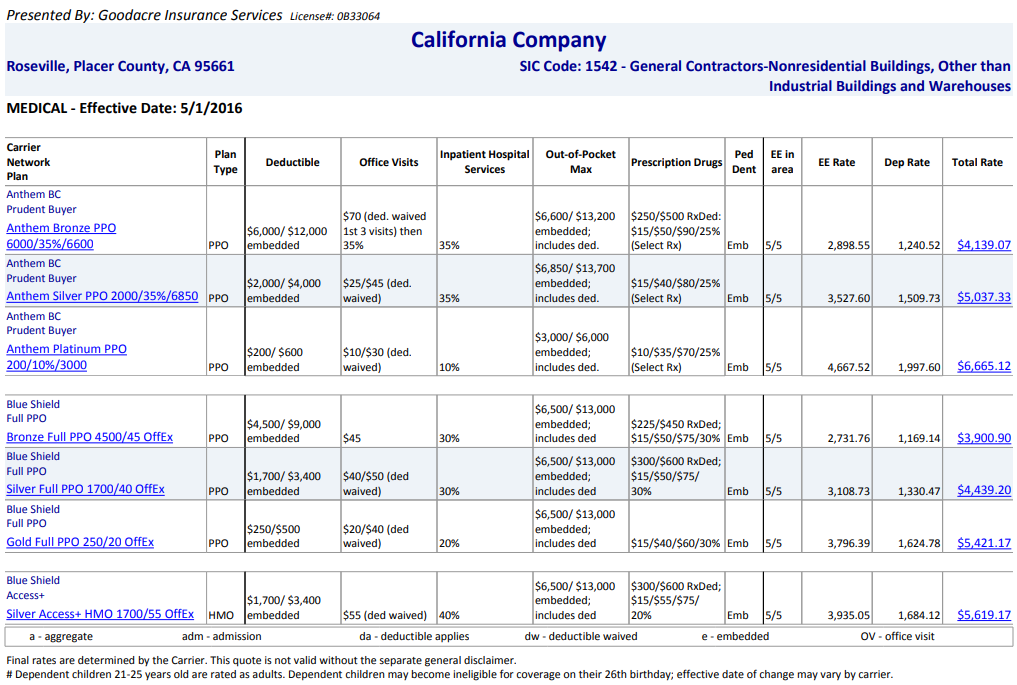

The first thing we do with the census info (just need zip codes and

dates of birth) is run the market.

We immediately quote all the major carriers at the Silver level (PPO or HMO depending on what you want).

The silver is by far the most popular plan since it's priced well

(the ranking is bronze, silver, gold, and platinum in increasing order).

It's the lowest priced plan that adds in office and RX copays before the main deductible which are very popular.

The premium spread from carrier to carrier can ridiculous!

Up or down 20% in some cases. This depends on area and ages of your employees.

The best priced plan in one area usually isn't the same one in another area.

It's very specific so we run the quote for every new company we deal with.

There can be dozens of plans but we know how to compare apples and apples (network, core benefits, etc).

For example, you can have "narrow" PPO networks which are cheaper but have fewer providers in the network.

Here's an example:

Same for HMO's.

We have these narrow networks in a pinch if we need to bring down the cost further.

Once we have the best priced Silver plan from among the top carriers (we send this master report so you can see the results), we can run the full quote within that carrier.

One note..we can actually offer Kaiser along side other carriers (even PPO plans) to offer a full choice for companies in strong Kaiser areas!

Let's now take this info and make it accessible to the company and

even employees!

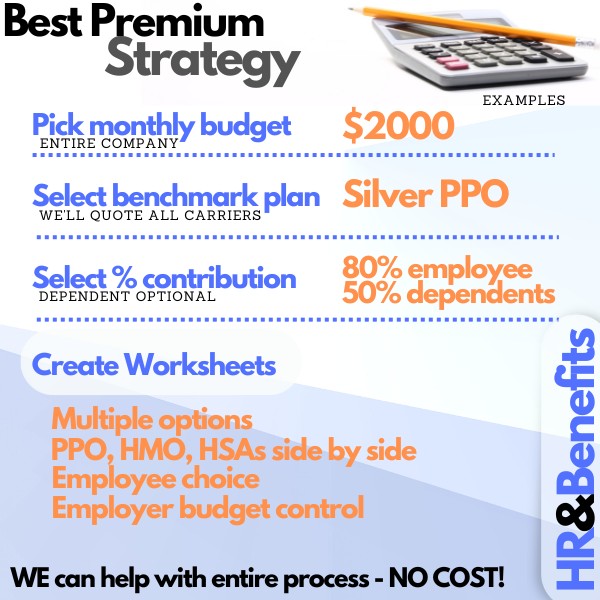

Establishing the monthly budget and benchmark plan

We now know which carrier is priced best in a given area.

Next up, we run a quote within that carrier at different benefit levels:

- Bronze (maybe with or without HSA - more on HSA below)

- Silver (our

benchmark)

- Gold

- Platinum

We can mix and match PPOs and HMOs depending on what you want.

Let's say for a company of 5 employees, we have the following total monthly cost:

- Bronze - $1500

- Silver - $2000

- Gold - $2500

- Platinum - $3000

Maybe the company wants to pay no more than $1500/month.

Perfect...we can set a 75% of the silver as our contribution level!

The employer can contribute any number from 50% against any plan and we can even set a fixed amount ($300/employee/month).

Lots of ways to slice this to make sure the company's budget is maintained.

You can set a different contribution for employees versus dependents (including not covering dependents).

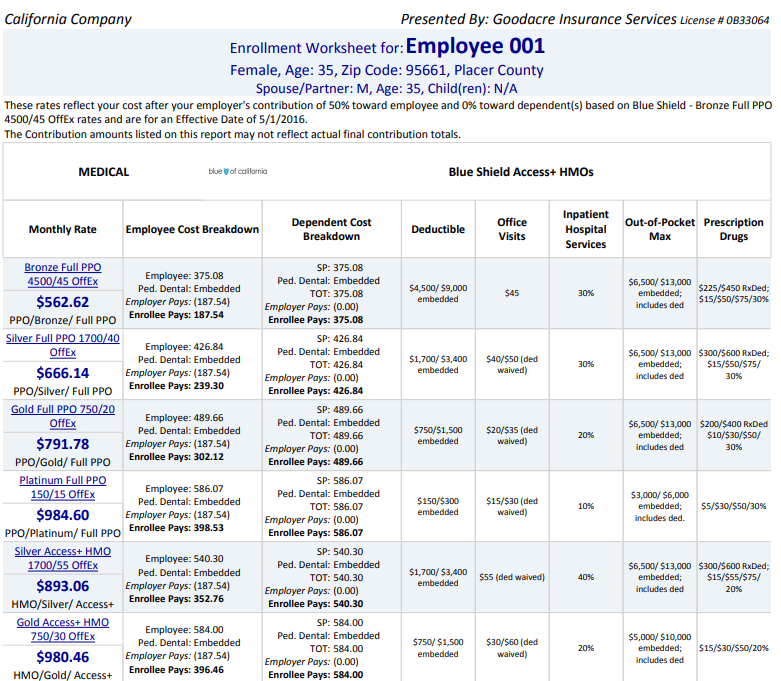

Here's the great part.

We'll generate worksheets for each employee that shows their cost after the contribution is taken out!

Here's an example:

They can pick from any plan offered but the company's contribution is locked in!

One note...the % option is best since a fixed dollar amount will really hit older workers hard.

This is THE way to go now for employee benefits:

Company controls its budget. Employees have full choice based on their healthcare needs and budget.

We can do all of this for you as license California agents and there's ZERO cost for our assistance.

Request quote here:

That important CoveredCa note before leaving.

The reason employees will want to stay with their Covered Ca over going to an employer plan is the tax credit.

Based on income, they may be getting pretty ridiculous tax credits. They (or you) can run quotes here.

Here's the catch. If an employee is offered "Affordable" employer health coverage, the tax credit goes away!

The measure:

The group plan costs them under 9.12% of their gross income

So...you may want to take this into account when setting that budget so it doesn't blow apart Covered Ca plans for employees. We can help with this process! It's pretty confusing.

More saving tips please!

How to avoid the double-coverage conundrum

At the other end (richer employee benefits), we want to avoid double-coverage.

Employer plans will coordinate or work together.

Meaning, I could have a plan through my employer and also be on my spouse's employer (not individual) plan and they'll work together to lower my cost.

That's great for the employee but it's a super expensive form of insurance.

You as the employer are still paying for a 100% plan but now the cost/risk is split in half with another employer plan.

We see this with 100% or very high contribution levels.

Meaning...you're paying most of coverage on your group plan for the employee and/or dependents.

We have companies in very competitive fields (tech, professional, etc) that are competing with large corporations for talent.

They may want to pay 100% of employee and dependent coverage.

It might make more sense to pay 100%/90% (employee/dependent) or less so that an employee is less apt to have double-coverage through a spouse...especially for dependents.

You could offer other benefits in lieu of this the sharing such as dental, vision, life, etc.

You just don't want to pay 100% for a health plan that's splitting duty so there must be some skin in the game from the employee to make less attractive.

Let us know your field and we can help you navigate the sweet spot for this calculation when we run the quotes.

Annual check up for employee benefits

We remember a time when a given carrier in a given area would be the price leader for years!

That's not the case now.

Many employers reach out to us with existing benefits only to find they've been overpaying versus other carriers and even other plans within their same carrier!

We're talking $1000's each year.

At renewal (ideally, that's been brought back to Jan 1st after all the shenanigans back around 2014), we need to run a temperature check on the market.

Same approach from above or we can tailor it to the plans you currently have.

Send us the current employee/plan make up and we'll cross-check it at no cost to you.

We can even send a secured form so you can upload recent bill and we'll get at it.

If you're on the best priced options, we'll tell you that! We do all the time.

If not....we can discuss and even help with the change-over.

You would be surprised how much more you may be paying for similar coverage.

Keep in mind that since 2014, the plans are standardized.

Meaning...a Silver plan within or between carriers must be tied to a benchmark +/- 2%!

The networks can be very difference so we need to compare apples and apples but we do this for you.

It can be done anytime of the year but definately at renewal. We do this for all our clients and new options are priced better about 30% of the time.

That's millions that companies are overpaying every year. Don't be in group.

We're throwing all these tips at you but you're already too busy running a business (or HR).

Okay.

Get expert help who works with all the carriers

Outsource this to a professional. Sure, the questions that come during the year and changes needed (employees coming and going, claims, etc) are helpful but in the end, we can save you money.

A few notes.

There's no cost for our assistance. The pricing will be the same through us, another agent, or direct with the carrier.

If you have coverage direct with the carrier, that's a huge blind spot. Even with Kaiser!

We see renewals every month and the carriers will recommend plans. Sometimes, there are better priced plans not even on the renewal!

Look...getting your guidance from the carrier direct is akin to partial blindness.

We can't see the other carriers and we may not see the best options within the carrier.

Some of the plans have smaller networks so you'll see a savings but not realize that your employees can't use their doctors! (that's an uncomfortable conversation).

You really need a 3rd party advocate and that advocate is only as good as their reviews:

- 25+ years

- 1000's of California companies

- 100's of startups

Let us help you! Call 800-320-6269, email help@calhealth.net or request your quote and let us get to work!

More importantly, we can make any enrollment or change painless and avoid the common pitfalls that cause companies a bucket full of frustration.

Let's turn to a specific case.

The HSA option for employees

"I want to offer catastrophic coverage to my employees"

That's going to be a bronze plan but there are two types to consider.

The standard high-deductible bronze plan and the HSA qualified plan.

HSA Employer plans combine two pieces:

- A high deductible plan

- A tax-favored checking account

It's really the second piece that's quite original.

A company can get a lesser priced high deductible plan and either fund the HSA directly and/or allow the employees to fund the HSA account.

The funded amount is tax deductible to whomever makes it and those funds can be used towards medical and dental out of pocket expenses.

Unused funds roll-over year to year and earn interest or be invested tax-deferred.

Optum is a great administrator of the HSA funds and most carriers offer HSA qualified plans.

Depending on the type of company, this can be a very attractive option for both employer and employee.

Again, we're happy to help quote an HSA plans can be offered alongside more traditional plans.

We can help with this whole process to make sure it balanced in terms of funding.

People love their HSA accounts because they go based on the Federal guidelines of what's allowed which is much broader than what health insurance plans might cover.

Think chiro, acupuncture, hearing aids, etc.

Make sure to note interest in HSA plans if you want it quoted and we can even compare the cost structure versus traditional plans!

Let's look at tax credits for company plans.

Tax credits for small businesses - do they work?

We can actually get tax credits for small business plans in California!

It's tied to size of the company and average gross income of employee (excluding owners and their family members).

The general rules:

- Less than 25 full-time equivalent employees

- Average gross income under

$58K

- Employer pays at least 50% of plan premium (employee only)

The credit is on a sliding scale with a max cap at 35% of premium.

That can be thousands each year (for up to 2 years). This is found money if you're in the sweet spot.

We're happy to run your tax credit estimate with the quote here:

This is different than the tax credit that employees may get on their own through individual/family plans with Covered Ca (those can be quoted here).

Save time and money with Rippling

Over the past..say 5 years...we've seen an explosion in new HR platforms and the new entry is really dominating!

Rippling is leading the pack:

Think of it as an online (HIPPA compliant) HR system that makes all

tasks...easier and faster.

It's free to you! Payroll can be included (or integrated with 3rd parties) for nominal charge.

And we can help you set it up and manage it at no cost to you.

We have a whole review on the Top 10 tips around Rippling but health benefits are completely integrated!

For start-up companies who essentially want to "out-source" HR, this is the way to go.

One entry and benefits, payroll, compliance, etc all get updated.

The savings in time, energy, and money is phenomenal and it works great anytime a company has a fair amount of "transactional" work. Think onboarding, offboarding, etc.

We can include this in the quote here:

If you expect any growth, it's so important to set this up right away. Your future self will thank you.

Let's look at one way companies try to save.

Can a group pay for Individual Family plans

Technically...NO.

Employers can actually rack up pretty big fines paying for individual/family plans (including Covered California).

There is a new program called QHIHRA where employers can pay for individual/family through a specialized "wrapper" but here's the rub.

The employees can't get the Covered Ca tax credit if you're helping to pay via this method.

That can easily be $1000's per year that goes out the door.

So...this would only work if the employees make too much to qualify for a tax credit which is a pretty high number.

At that point, it's better to just offer a employer health plan since since unsubsidized Covered Ca plans have now come up to where group plan rates are.

Plus, Covered Ca plan networks are about 1/3rd smaller than employer plans!

The best doctors and networks are still in the full Employer plan networks compared to Covered Ca (individual/family)

So...it's lose-lose.

Watch out for people pitching this without explaining the tax credit piece.

Those are some of our best tips that most employers can take

advantage of RIGHT NOW!

One final note as a token of what we bring to the table for our

companies!

Bonus: The employee gifts

A quick grab-bag to show your employees you care!

Set up a POP 125 if you don't already have one!

This allows your employees to pay their share with pre-tax money (usually a 20-30% discount) and the employer saves on payroll tax.

Win-win and super easy to set up. Reach out to us for one today!

Preventative is covered at 100% on ALL plans. Even HSA's.

It must be in-network and for covered benefits but this can include:

- Annual preventative benefit

- Annual pap/mammogram

- Colonoscopy over

certain age

- Associated labs for above (this is where the real cost savings are!!)

Sometimes, the provider won't code it correctly. Make sure it's coded and asked for as "preventative". Not tied to a particular ailment or symptom.

This can be up a $1000/year in savings!

Dental and/or vision can be offered on a voluntary basis. Meaning,

employees can get it and pay the premium.

They can even use the POP125 from above to pay pre-tax!

The new retinal scan benefit on vision is ridiculous and must have.

A simple (and covered) procedure where then can see year's in advance:

- Diabetes

- Dementia

- Cardiovascular disease and health

- High blood pressure

The list keeps growing and you can catch things early!

Fantastic benefit and super cheap to offer.

That's a wrap. Reach out to us with any question at 800-320-6269 or

at help@calhealth.net