California Startup Health Insurance - Do Start Up Companies offer a Health Plan

Do Small Start-Ups Offer Health Insurance?

We have helped 1000's start-ups navigate the tricky question of health insurance for 25+ years.

This is usually the first question and as with so much surrounding a new enterprise...

It depends!

We'll get into the constraints that drive the final answer but usually, it's a question of time...more when than if.

The issue is that usually the decision is delayed and we're in crunch time to quickly ramp up a start-up employer plan to attract a new key employee.

Let's walk through how we can avoid this process but also keep our cost structure completely manageable.

We'll cover these topics:

- Do small start-ups offer health insurance

- How to jump-start the new company health plan

- What is needed for a start-up health insurance plan

- Getting the best value for start-up health benefits

Let's get started.

Do small start-ups offer health insurance?

This really depends on the industry you're in.

Don't think of it from the employer's point of view...do start-ups offer a health plan?

Look at it from the employee's point of view.

They're looking at multiple offers including your start-up.

Sure, the calculus changes a bit in that they may be willing to forego some bells and whistles from a larger company for the growth potential of a start-up but it really comes down to the type of business you're in.

For example, in tech or biotech startups (not to mention the AI explosion), tech start-ups generally need to match competing options.

It's just expected even though they're a new entity with more growth potential that health benefits will be offered.

This is seen as a given (for our geometry buffs).

There's also risk with a start-up from a new employee's view so the benefit offering removes a key mental roadblock to joining your start-up.

We see this all the time with new start-ups. The cost calculation of offering health benefits is quickly superseded by the ability to attract key employees, especially so early in the start-up's growth when the quality of employees is critical.

Again, this really reflects how competitive the labor market is for your type of industry and that particular skill set of the employee.

The more competitive and sought after, the higher the likelihood that you need to offer a health benefits package.

Why not just offer more pay and have them go to Covered California?

They'll likely not qualify for a tax credit with higher income and lower age (typical for start-ups) but more importantly..

The Covered CA doctor networks are about 1/3rd smaller than business plan networks

This can be a real issue in that they won't be able to see their preferred doctors or worse yet, it can be difficult to use premier medical groups like Stanford, Cedars, etc.

Not offering a start-up health plan combined with reduced doctor choice can be a deal-breaker.

For some employees, it might be THE deciding factor if their spouse or child can't see the specialist they're tied in with at Standford.

Let's remove that from the calculation but also afford the process.

First, the timing issue.

How to jump-start the new company health plan

For most start-ups, the health plan is a tier 2-3 action item...down the list.

There's just too much else to do for the core business and we get that.

The problem we usually see is when a start-up comes to us and says...

"We have a key employee we want to hire now but they won't come on without a health plan (for the reasons above)"

This creates a bit of an emergency scramble which is never fun when you're trying to keep a prospect engaged.

We can turn it around but usually in a week at best!

A better approach is to create the basic architecture now so it's ready to go.

A few notes on this approach.

We may not need to enroll the owners right now. We'll look at the minimum requirements below but there are qualified "exemptions" from the participation requirements that we can use to have the group plan ready for actual prospective employees.

This avoids the cost for owners and founders unless you want them to enroll.

We can help with this whole process and there's no cost to our assistance!

Reviews here:

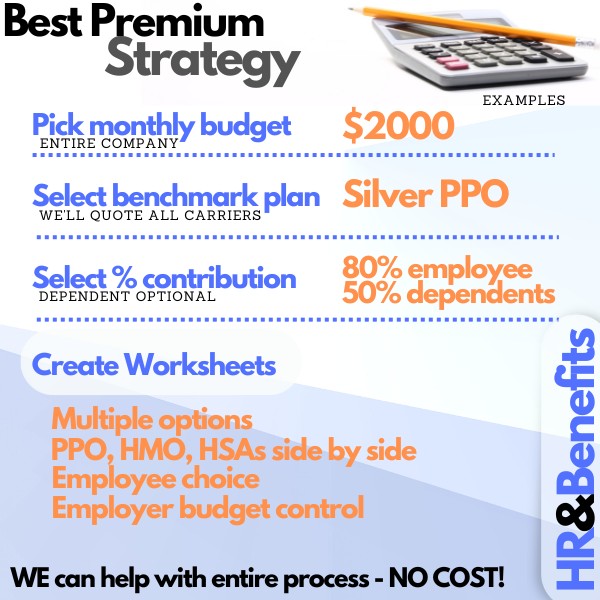

We can also structure the health plan to offer a range of plan options with a

fixed contribution (either % or dollar amount) from the employer.

This gives the start-up some control over the budget while providing maximum choice to the new prospective employees.

It's a win-win and we'll discuss below how we do this

.

The main concern is to have the skeleton of a group plan already created and in effect, so new prospects can be offered coverage as part of the package.

Having nothing available for a hotly contested candidate really affects the perception of the company...even for a start-up.

Look like you're as big as the competing firms even if you're not there...yet!

A benefits package can be offered on day 1 is key to this and we need a little time to put this together.

Better to do it before the full roll-out.

So...what do we need at a bare minimum for a start-up plan?

What is needed for a start-up health insurance plan

In California, we need at least one employee who is not the owner or owner's spouse on payroll.

Technically, they can be tied via ownership (officer, LLC member, sole proprietor, etc).

There's just a weird caveat about the owner/spouse.

If we have two partners for example who are not married, that's fine as long as one of them is enrolling or if we have an employee on payroll (who is not the owner's spouse).

Payroll is the easiest approach but we can work with an ownership structure worst case.

So...to flesh it out, we would want the owner on the plan to get the ball rolling before we have employees on payroll.

This owner may be able to come off later once an employee is on payroll.

We're just trying to set up the group plan framework with minimum requirements.

Technically, we need this "relationship" (payroll or ownership) for 1/2 of the prior calendar quarter or 45 days but some carriers are flexible around this now for start-ups.

We know which carriers to work with for particular situations so run your quote here and we'll match up accordingly.

This addresses how we have the start-up health plan ready for future hiring.

Let's look at the cost side of things.

Getting the best value for start-up health benefits

Here, we have a great approach for start-ups that consistently wins on both accounts (cost and employee reception).

First, we shop the market across all the major carriers to see who's priced best for your area:

There can be huge differences across the carriers depending on area and

demographics.

Once we narrow the best-priced plan at a given benchmark (usually the Silver plan), we then run worksheets for employees across a range of benefit levels.

We can lock in the employer's contribution at a given percentage or dollar amount.

For example, the start-up may pay 75% of the silver plan.

The employee can then pick bronze, silver, gold, or platinum and the employer's contribution stays fixed based on the 75% of silver.

The worksheet reflects all of this and makes it easy to compare.

It's the best of both worlds, especially with an uncertain hiring requirement in the future!

We can manage this entire process and even apply the same rules to dental,

vision, etc.

We also recommend getting set up on a benefit platform if you expect to ramp up hiring into the future (most start-ups do).

This can also take over the payroll, compliance, and benefits side which you definitely want to off-board.

Rippling is the best-in-class for this type of platform and we can help with the whole process (at no cost to you).

This doesn't have to be done at the same time of building out the benefits plan but if you expect any sort of hiring spree over the next 12 months, it's better to do this in one process.

Again, we'll guide you through the whole process on both sides so you have a seamless plan offering that is integrated with payroll/compliance and with the smallest footprint for your new start-up.

Reach out with any questions or request your quote and we'll get to work. We love growing benefit plans for startups!

Email us or call at 800-320-6269. We can run the full quote here:

.jpg)