California health insurance - Guide to Individual health insurance - Major Medical insurance in California

Finding the Best Values in Major Medical California Insurance

The term Major Medical is constantly interchanged with catastrophic health insurance on the California market but regardless of the name, it makes more and more sense to go this direction on the health market.

Let's look at how Major Medical California health plans work and which ones are currently the best priced options on the market.

These are the typical ways to address major medical needs:

- Bronze level ACA health plans

- Short term health plans

- Health Sharing options

You can always run your Major Medical plan quote here:

- Exchange Bronze plan

- OneShare health sharing (short term is no longer available in California)

Major Medical brings health insurance back full circle

Major Medical California coverage generally refers to health coverage designed to cover the big medical bills that can bankrupt or seriously impact Californians financially.

Health insurance in California actually started out this way with basic high deductibles that you met before coverage would start.

In the 80's, with the advent of PPO's and HMO's, richer benefits came into play (think copays and low even no deductibles).

Major Medical plans took a back seat until the rates came roaring back and then out of financial necessity, Californians started to rethink major medical options with lower monthly premiums.

Let Us look at how major medical health plans work.

It's all about the deductible and Out of Pocket maximum for Major Medical

There are two main ways that Major Medical health plans keep cost low.

The first is the deductible.

The deductible refers to an amount of money (let's say $5000) that you must pay first before getting help from the carrier.

Keep in mind that you will still get the PPO negotiated rates when in-network and using network doctors.

This can bring your true out of pocket down by 30-60% in most cases.

The second is the max out of pocket

Once you meet your deductible, you generally pay a percentage until you hit the OOP or Out of Pocket Maximum.

The plan generally pays 100% of remaining calendar year covered benefits, in-network.

For some HSA major medical plans, the deductible is the same number as the maximum (all-inclusive).

Let

Us look at a Major Medical plan example.

Let

Us look at a Major Medical plan example.

Let's say you have a $5000 deductible and $6200 max out of pocket (separate amount) and you get a $50K bill.

You would first pay the deductible of $5000.

You then start to pay 30% of the remaining charges until you hit another $3500 out of pocket for a total of $6,200K towards the $50K bill.

Assuming in-network and covered benefits, the carrier would pay the other $43.8K.

That's the whole point of major medical health plans...cover the big bill.

What's the trade off or benefit?

Premium savings.

That $5000 deductible major medical plan might be a few thousand dollars cheaper than a richer plan (say a $1000 deductible).

In a bad year, that savings offsets the higher deductible.

In a good health year, you keep the money.

That's why more and more people are going towards major medical plans.

So which plans on the ACA market are the best values for major medical?

Current good values for California major medical health plans

Right now on the individual family Exchange health market, we would consider the following major medical health plans when you run your quote:

- Bronze plan

- Bronze HSA option

- Catastrophic for people under age 30

You can access the online application here:

One note...if you're eligible for a tax credit, it will not apply to the catastrophic plan so the bronze would be the better bet!

Short term health for Major Medical

Many people are turning to short term health plans to provide catastrophic coverage.

This is basically becoming our non-ACA (Obamacare market) option.

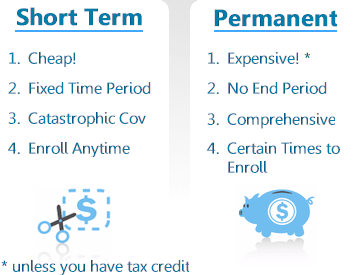

Some key differences:

Short term was banned in California a few years back so we don't really have that option now!

Health sharing is the closest equivalent and you can quote that here.

Here's a comprehensive guide to short term health for catastrophic coverage.

You can quote major medical short term here.

Covered Ca and Major Medical

The ACA law (Obamacare) sets benchmarks for plan levels and we cannot get a higher deductible than the bronze plan.

We're happy to walk how these plans compare for your specific situation.

Our services are free to you and we can look at tax credits through Covered Ca

Either way, call us at 800-320-6269 and we'll help you with the entire process.

There's no cost for our services!

Important Pages:

Simple Tips on Comparing Covered California Plans

You can run your California Major Medical Plan Quote here to view rates and plans side by side from the major carriers...Free.