California Medicare Options - Los Angeles Medicare Giveback Advantage Plan Comparison Review

Los Angeles Part B Giveback Advantage Plans Comparison

Los Angeles is one of the best markets for the incredibly popular Giveback plans in the entire country.

Where some counties don't have of these Advantage plans, Los Angeles boasts many and it seems to be growing with each year.

Enrollment sure has as it's gone from 2% of the Advantage market to over 13% in a few short years. Over 6x's!

This was before the massive run up in the cost of everything so we expect that to continue.

We'll cover the major plans and how to compare them below but first, our credentials:

This is what we'll cover:

- Quick intro the Giveback plan option

- Why Giveback Advantage plans work so well in Los Angeles

- Comparing the Los Angeles Giveback plans

- How to quote and apply for Giveback Advantage in Los Angeles

Let's get started!

Quick intro the Giveback plan option

We have a big review on the Giveback plans explained or how to compare Giveback plans but a quick intro is in need.

Giveback plans are Medicare Advantage plans that have a specific add-on benefit. We have a guide to Advantage plans for more info.

The add-on benefit works like this:

Most people with Medicare pay a monthly (or quarterly) premium for their Part B benefit (think doctor costs) to Social Security.

This amount averages $174/month now and goes up each year. It can be higher or lower depending on your past income.

Even at the $174/month, that's over $2000 per year going out the door!

A lot of money for many people especially with the state of inflation.

So...the Giveback Advantage plans will pay this Part B premium up to a given benefit level which differs by plan.

For example:

- Part B premium is $100/month

- Giveback benefit is $80/month

- You'll get a bill for $20/month (the difference between the two)

You can never get more than what your Part B premium is so we can use this when comparing the plans.

But why are Giveback advantage plans so popular in Los Angeles?

Why Giveback Advantage plans work so well in Los Angeles

This partially comes down to the fact that they are Advantage plans to begin with.

Most of the Advantage plans (including the giveback variety) are HMOs and HMOs work very well in more populous areas.

So...like Los Angeles? Yes!

Big base of doctor networks and medical groups. Even bigger base on enrollees.

This is what you need to make HMOs and Advantage work and by work, we mean:

- Lower premium (zero for most LA plans)

- Lower deductible (zero for many LA plans)

- Lower out-of-pocket max's (lowest in the State)

- Richer benefits (including the Giveback benefit)

The other piece where LA shines is in the networks available.

We can get access to really good medical groups and hospitals with Advantage plans:

- Optum, Heritage, Regal and many more

- UCLA, Keck, Huntington, and Cedars (plus many more) hospitals

An Advantage plans is only as good as the providers you have access to as we'll discuss below.

If you're going to have a Giveback Advantage plan, Los Angeles is probably the place to do so.

So...how do we compare the LA options?

Comparing the Los Angeles Giveback plans

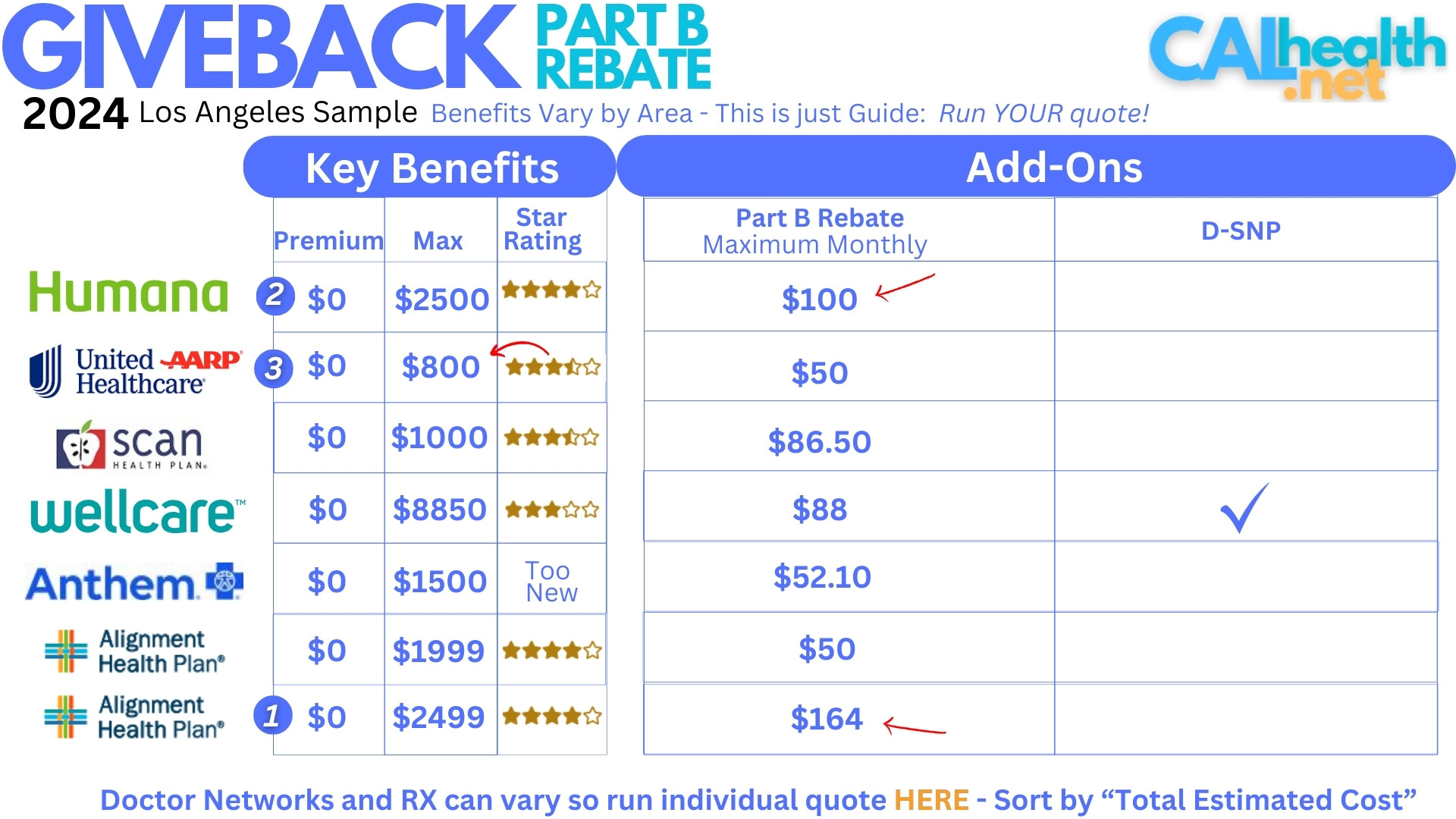

Let's look a sample of current Giveback plans in Los Angeles knowing that it changes year to year and not every option might be available in your area.

Lots to cover.

First, we see that they all have zero premium and deductible.

There's quite a bit of variation among:

- Star ratings

- Giveback benefits

- Out-of-pocket Max's

Check our our comparison of Giveback plans for more detail but here's a good strategy.

We want Star Ratings of 4 stars or higher ideally. This tells you how enrollees feel about the plan and it's incredibly valuable to our comparison.

The giveback benefit ranges from $50 to $174. Your actual Part B premium figures in here. If it's $100, there's no reason to go higher all other things being equal.

The Alignment giveback plan is really popular due to it's high benefit of $164 (almost the full average Part B premium).

The out-of-pocket maxes really differ but our favorite 3 are comparable when you subtract out the giveback benefit.

Meaning...the $2400 max minus almost $2000 in giveback is around $400 in real exposure during a really bad year.

UnitedHealthcare® has a low max of $800 but lower giveback benefit. Humana is a blend between the two.

The Wellcare max is much higher but if you have medi-cal, it should help with this exposure which explains why it's so out of bounds.

The real question then comes down to doctors and hospitals we want access to.

If you're flexible, you can then go based on Star Rating, Giveback benefit, and out-of-pocket max.

Otherwise, we need to choose according to our doctors list. Let's go there now.

How to quote and apply for Giveback Advantage in Los Angeles

We make this fast, free, and secure and give you complete access and control (refreshing right??) here

A few tips to get the most accurate quote and best options for you:

- Filter for "Part B Giveback" plans

- Under preferences, enter your doctors/hospital

- Enter your medications/dosages

- Enter your preferred pharmacy

- Sort by "Total Estimated Cost"

That's it! You'll now see the Los Angeles Giveback plans available and you can see which ones will work with your doctors and medications!

Applying is even easier. Just "Add to Cart" and the system ties directly into the carrier's enrollment systems.

If you're on an existing Advantage plan, the old plan will cancel when the new one is approved.

For those thinking...this is too much work or I have questions (it can be confusing), just reach out to us and we'll help at no cost to you.

help@calhealth.net or pick a time to chat:

Now you have a much better understanding of what all the hubbub is in Los Angeles around Giveback plans without all the salesy push!