California health insurance -

California carrier

comparison - Kaiser versus Health net

California health insurance -

California carrier

comparison - Kaiser versus Health net

Kaiser versus Health Net of California

In some areas, Kaiser and Health Net go head to head.

For very particular plans and in certain market segments.

This is really the battle of the dominant HMO's on the market.

- Kaiser invented the HMO model and put their own twist on it. (we'll explain later)

- Health Net started as an HMO and later brought PPO's into the mix.

But don't confuse things.

HMO is where these two carriers step into the ring.

We'll compare the two at a top level first.

First...some credentials Please!....

We'll then look at the 3 big market segments they compete in since there will be strengths and weaknesses specific to the market segment.

You can jump right to those sections here:

- Individual/Family (including Covered Ca which both carriers participate in)

- Small Business (1-100 employees)

- Medicare (Seniors age 65+)

You can always run your quote here:

Let's begin.

How do we compare Kaiser and Health Net Statewide and marketwide?

Kaiser versus Health Net - Similar but Different

Although both carriers use the HMO model as their lead-in, they go about it very differently.

We'll explain how this affects you across 3 main criteria:

- Price

- Network

- Customer Service

First, let's explain how they both approach the HMO model uniquely.

HMO Primer for Kaiser Health Net comparison

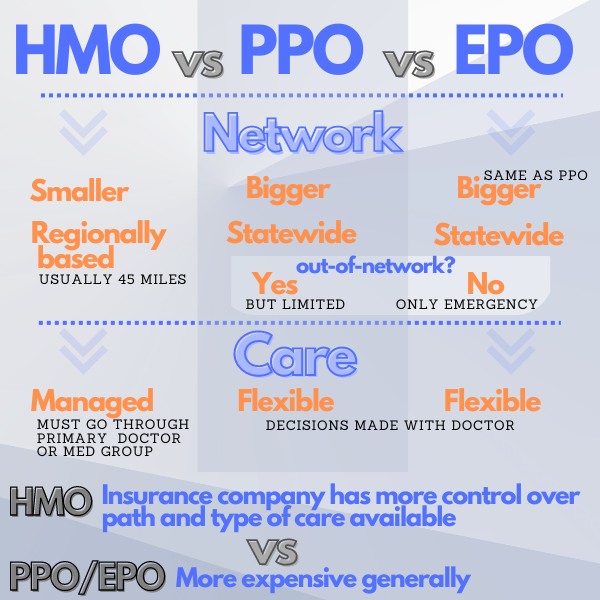

We need to touch base on the HMO model itself.

HMO stands for Health Maintenance Organization.

This is the alternative to PPO plans.

So how are they different?

HMO is really a tradeoff of cost and control/flexibility.

Keep in mind that the benefits are now standardized with the Bronze,Silver, Gold, and Platinum benefit levels.

A Gold plan has to match another Gold plan +/- 2% in core benefits.

HMO's used to have richer benefits but that's no longer the case after the ACA law.

So what gives?

It's the cost difference versus more "managed" care.

You can find out more about HMO versus PPO here.

Let's look at how Kaiser and Health Net use this basic model.

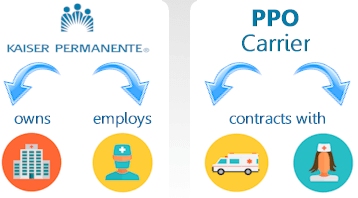

Kaiser HMO model

Kaiser went all in!

- They actually own the hospitals and employ the doctors.

- The insurer is also the provider of health care.

This can be good and bad at the same time.

On one hand, everything is integrated.

- Medical records

- Care coordination

- Billing

That's kind of the holy grail of health care and Kaiser definitely has a head start.

Having your medical records available to every doctor and having them communicate with each other as a team is a huge asset.

The other attribute that people consistently like is that everything is in one place.

The hospital. The lab. The primary care doctors. The specialists.

One place generally.

This harkens back to the 50's when the hospital was your main location for doctors and labs as well.

Okay. Those are some of the positives of Kaiser's model along with pricing of course.

What are the drawbacks?

Kaiser's negatives

Let's talk about our feedback from Kaiser members on the downsides to their integrated HMO model.

Most of it has to do with choice.

Choice of doctor and choice of care.

Let's tackle each one separate.

Choice of Doctors

You must use Kaiser providers when you have them as the insurer outside of very limited situations.

This works just fine for the vast majority of healthcare needs.

Everything from primary care to maternity.

They have competent and experienced doctors and facilities to address health care needs.

The problem occurs with more exotic or complicated health care needs.

None of us think we'll get them but surprise!

We get the calls daily from clients.

- There may be a specialists who's the best at knee replacement.

- Or a cancer center who's using new gene therapy treatment for a specific type of cancer.

With an HMO, you may (probably) not have access to these facilities and doctors.

You have to stay in the Kaiser network and use the doctors and facilities that they have.

Again, this is rare but rare health care issues do come up. Think of everyone you know and bizarre health situations you've seen.

There are rare situations where Kaiser will allow a member outside their network if they truly do not have a provider in that area.

There's a difference between having a provider and having the leader in the field.

That's where people get upset.

The other issue is more of an issue with HMO's.

Choice of Care with Kaiser HMO

This is more common.

Since the insurer is also the medical care provider, there is a cost consideration in terms of course of treatment.

A member may see this in terms of the medications prescribed or the labs requested.

Even the procedures undertaken.

This more deliberate pace is not necessarily bad as the alternative (PPO) can sometimes lead to too much care (at great cost).

This management of care is a function of HMO.

Even with private doctors/hospitals HMO, the insurer (such as Health Net) shares the financial exposure with the provider.

This builds in a cost constraint as well.

Kaiser's embrace of the HMO model and the fact that they are full integrated brings out this cost constraint to its full measure.

Again...good and bad depending on where you are healthwise and how much control you want over healthcare decisions.

The doctors are obviously going to make decision based on improving your health.

But

There will be a cost consideration behind this decision process.

That's HMO. That's Kaiser.

What about Health Net's HMO model (we'll talk about their PPO separately)?

Health Net's HMO Model

Health Net started as an HMO.

In fact, the State forced what was then Wellpoint (now Anthem Blue Cross) to split off their HMO business into a new company.

Health net was born!

They went into PPO aggressively when HMO's lost some of their cost and price advantage but HMO is still at the heart of Health Net.

We've talked about the HMO difference in general.

How does Health Net's model differ from Kaiser?

Independent Doctors and Hospitals

Essentially, Health Net functions in the standard capacity.

They contract with independent doctors, medical groups, labs, and hospitals.

This works well if you have existing relationships with doctors/hospitals (and they're in the Kaiser network).

This is also the de facto option if Kaiser is not available or strong in your area.

In this relationship, Health net will pay a doctor or medical group a fixed amount per month for each person they provide care as part of their HMO contract.

The doctor then manages the health care...ideally within this monthly "budget" so they don't go broke.

That's where the cost constraint comes into play.

The net effect is the same in terms of management of care but now we can use different doctors.

HMO decision between Kaiser and Health Net

So with an HMO, it all comes down to pricing and which doctors/hospitals you want to see.

Kaiser might be a bit more integrated for the HMO model while Health Net might allow you to see different providers.

That's the trade off.

Of course, pricing is key and you can quote both Kaiser and Health Net here:

Let's look at the PPO angle with Health Net.

Health Net's PPO

Kaiser is basically an HMO provider.

Health Net offers many different options including PPO.

With PPO plans, you have a list of providers with which you'll get discounted rates!

You can go off that list and it's more expensive but it's available if needed.

Here are the trade-offs between HMO and PPO (more detail here):

Health Net's PPO differs based on the market segment we're looking at (individual, group, Medicare) so it makes sense to look at your particular market.

Let's look get into those now:

- Individual/Family (including Covered California)

- Small Business (1-100 employees)

- Medicare (Seniors 65+)

Individual and Family Comparison for Kaiser and Health Net

First, both carriers participate in Covered California and offer ACA health plans both on and off-exchange.

By law, the plans are standardized so this makes it easier to compare (a Silver plan is a Silver plan +/- 2% in core benefits.

Where we see Health Net and Kaiser go head to head is with the HMO plan in certain areas.

For example, most of LA County.

When you run your on-exchange quote here, it's not uncommon to see Kaiser and Health net with the lowest pricing for their HMO plans.

Usually a few regional HMO's might also compete. Let's look at the components for the comparison.

We'll have to break out HMO and PPO separately since they're very different.

We'll start with what's on everyone's mind: Pricing!

Pricing for Individual Family plans

Let's start with HMO.

As we mentioned above, Kaiser and Health Net HMO plans are generally the best priced plans at a given level (for example, Silver).

LA Care, Western Health Advantage, Sharp, and Molina will also compete if available in your area.

It makes sense to quote on-exchange since we can only get tax credits there and the plans, rates, and benefits are mandated to be the same on and off exchange.

We'll generally see Kaiser and Health Net in a 10% price range for comparable coverage.

PPO or EPO for Health Net

The PPO or EPO plans are available through Health Net and they will generally be about 20% higher than the HMO in a given plan.

Most individual/families have chosen either Anthem Blue Cross or Blue Shield for PPO since the pricing is comparable and the networks are bigger.

Health net is falling back to it's roots as an HMO carrier due to pricing on the individual market.

You can quickly run your quote here to see who they compare for your situation.

Make sure to put in your income and household size so you can get a tax credit if available.

There are situations where a carrier's PPO or EPO is cheaper than their HMO for a given age/area.

In that case, you would go PPO/EPO since it's more flexible and benefits are standardized.

Now on to where Kaiser and Health Net differ quite a bit: Network.

Individual and Family Network differences between Health net and Kaiser

As we mentioned in our general comparison between the two carriers, pricing can be comparable so...

It's more a question of which doctors and hospitals you can use!

- With Kaiser, you must stay within Kaiser facilities and use Kaiser doctors.

- Health net contracts with independent doctors, hospitals, and medical groups.

They do this on an HMO or PPO basis depending on the plan you pick.

Check out this great introduction to the HMO versus PPO difference.

The Health net HMO will still have some of the limitations associated with the HMO model...you just get to use independent doctors.

It comes down to your doctor relationships and availability.

Important: The individual/family networks are smaller than the group networks!

In or off exchange.

If there's a doctor that you want to keep, ask them what "Covered California" plans they participate with.

This is usually the first step.

When you run your quote below, you can click on Provider Finder to see what doctors are associated with a given plan.

Right below the Health Net HMO plans, click on that to bring up the correct network search.

One note...the Health Net HMO networks can be one of the smaller one in a given area except San Diego county where they're pretty strong.

Again, LA county comes to mind.

Make sure you like the doctors.

We can change plans and carriers at open enrollment each year

Health Net PPO network

Unless someone is solely making a decision based on price, Health Net's PPO plans are generally overlooked for Blue Shield or Anthem simply due to the size of the network.

That being said, there are situations where a medical group only takes Health Net HMO or PPO.

We've seen it occasionally especially in the high desert and throughout Southern California.

Always good to check with your doctor or hospital.

If you want PPO/EPO and Shield or Cross are less expensive (which is common), that's probably the better direction.

Member Services for Individual/Family

Kaiser probably works better here in terms of the day to day interaction with members.

This is understandable since they've integrated the whole process (health care delivery, billing, claims, etc).

It's all one house and they've invested heavily in systems to make it all communicate together.

That's one of the strengths of Kaiser.

Health Net's member services are working to get up to par but all the carriers really will have difficulty streamlining the process the way Kaiser does.

They still are dealing with a 3rd party - the doctor, medical group, or hospital.

But that's why you may want them.

It's YOUR doctor!

Online services are improving across the board for all the carriers and we highly recommend registering your online account.

This gives you access to billing, claims, networks, and a variety of useful resources.

You can run your Kaiser - Health net quote here for individual and family.

Feel free to ask us any questions at 800-320-6269 or help@calhealth.net Our services are free to you!

Small Business Health Comparison between Kaiser and Health Net

The Group market is different from any other segment of course.

Our comparison definitely reflects this with these two carriers.

To some extent, it's an unfair comparison as Kaiser dominates the employer health market.

For one good reason.

Cost!

Group health rates have roughly doubled in the past few years and price has become the primary concern.

Maybe even the linchpin for continuing to offer employees coverage.

We can quickly run the numbers across the carriers for your company but Kaiser will probably be the price leader.

Definitely versus PPO but even on the HMO front, it's hard to compete.

There is one place where Kaiser feels the heat from Health Net that's specific to the group market.

Networks

Individual/family really only has one HMO or PPO networks.

The group market is different.

Carriers are able to offer narrow network options at the Bronze, Silver, Gold, and Platinum level.

This is where Health Net can start to compete with Kaiser.

Their narrow HMO network.

So how do we evaluate these two and do we even need to?

When you request your group quote, you'll also get access to provider networks.

We can see if your employee's doctors are in-network with the narrow networks.

We'll check the hospitals as well.

The reason we may not have to in probably more intriguing.

The Health Net Kaiser Wrap

Kaiser is unique in that they don't care how many people you enroll.

Other carriers have very strict rules on participation.

Kaiser will allow you to offer Kaiser side by side with Health Net.

This is the best of both worlds.

We can offer each employee one worksheet.

- They will have Kaiser options.

- They will also have Health Net options.

The employer picks the options available.

The employer also picks the contribution level.

Better yet, we can base the contribution on a given Kaiser plan and that amount of money will apply to any of the plans...even the Health net options.

If Kaiser is a major player in your area, this is our strong recommendation.

- You'll have employees that love Kaiser.

- You'll also have employees that have relationships with doctors and hospitals outside of Kaiser.

Pleasing one side will upset the other.

No reason to do this.

Just offer the Health net Kaiser wrap and everyone's happy.

As the employer, you're able to control cost.

Request your quote and note that you want to look at a Kaiser wrap.

We'll see which HMO's or PPO's (usually what employer's want to wrap) is priced best in your area.

We can then pair the two together based on the contribution you want to make. We get the best response from our clients that use this option.

Request your Business Quote here:

Health Net's HMO versus PPO

Kaiser is mainly HMO.

Health net offers companies both HMO and PPO options.

Currently on the market, their HMO's are competitive price wise but the PPO's

have not been in terms of pricing.

Of course, pricing is always in flux so it's best to run an

updated group quote for your area and

employees.

We'll quote across all the PPO's to see who is best priced.

Customer Service for group plans

In terms of Employer plan customer service, the two carriers are pretty comparable and fairly easy to deal with.

They're both aggressive in the market right now which means that they tend to be more flexible when problems arise.

This is good news and of all the carriers, we definitely put them in the 2-3 in terms of billing, claims, membership issues, etc.

Medicare options for Health net and Kaiser

The two carriers have decided to go after different segments...very aggressively.

Of course Kaiser, being an HMO carrier, is fully invested in the Medicare Advantage market.

Health Net also offers Advantage Plans but they also offer Medicare Supplements which can occasionally be priced well

Especially for the coveted G plan (the gold-standard for supplements).

So this follows the usual comparison for Senior plans when Kaiser's in the mix.

Medicare Advantage versus Medicare Supplement

- Advantage Plans (HMO) with Kaiser providers - Kaiser

- Advantage Plans (HMO) with independent doctors/hospitals - Health Net

- Medicare Supplement Plans (PPO) - Health Net

It's important to understand Advantage plans versus Supplements first.

That's really our first decision since it directly affects pricing (significantly) and doctor choice.

You can quote both options and both carriers along the full range of other carriers here:

Of course, we're happy to walk through the pro's and con's of either carrier.

Health Net offers Advantage plans under Wellcare and Kaiser is the biggest provider of Advantaghe plans in the State which makes sense.

Again, it comes down to whether you want to use doctors/hospitals outside Kaiser.

You can quote both carriers below (we'll send link for doctor/RX and "opt-in" required by law to quote Advantage plans and/or Part D for medication):

Kaiser versus Health Net Final Notes

With Kaiser comparisons, we keep coming back to this common theme.

Do you want to stay within the Kaiser network?

Do you want more decisions on health care to be managed?

That's the trade-off really.

- In terms of Health Net's HMO, it's really a question of the doctors.

- In terms of Health Net's PPO, it's a question of doctors and control over health care decisions.

It can be a big decision and we're happy to help with any questions.

Feel free to call us at 800-320-6269 or email us.

Either way, we wish you a good fit for your health insurance needs.

Our services are 100% free to you!

Call us at 800-320-6269 and we can go through any questions or run your Kaiser versus Health Net quote. Thanks!

.jpg)

.jpg)

.jpg)