Save on Small Business Benefits - Quoting United Health for Restaurants

Our Services are 100% Free to You as Certified Covered Ca Agents

Confused? Call 800-320-6269

How to Get the Most Out of the Small Business Quoting Process

Any company can run a quote these days. In fact, any broker can do it for you as well.

The question is this...

Can you quickly find the best value for you and your employees without hours of learning an entirely new market.

Probably not but as agents with 25+ plus years experience, we can boil it down pretty well for you.

Here are the key points to a successful benefit search that we'll cover

- The initial plan and rate landscape survey

- Establishing your

monthly budget

- Mini cafeteria plan offerings

- The bells and

whistles (with very little cost)

- A seamless system for benefits and payroll (we got it!)

This is the best approach by far and we can hand-walk you through the process to make it painless..

Let's get started!

The initial plan and rate landscape survey

When you submit your employee zips and dates of birth, we can roll up the sleeves and get started.

We'll immediately take a benchmark plan (generally the silver - most popular tier on the market) and run rates across the carriers.

Depending on your preference, we'll generally look at HMO and PPOs separately since they can have different pricing advantages between carriers.

Generally, one carrier really shines in a given area based on your demographics.

We can also offer different carriers (usually with Kaiser as a separate option when dominant in an area) alongside a primary carrier (usually PPO).

Even though the plans are standardized, there can be huge price differences for a given group.

This is where our expertise really comes into play (there's no cost for our services as licensed California group health agents).

Once we zero in on the best priced carrier in an area, we'll turn to

your budget.

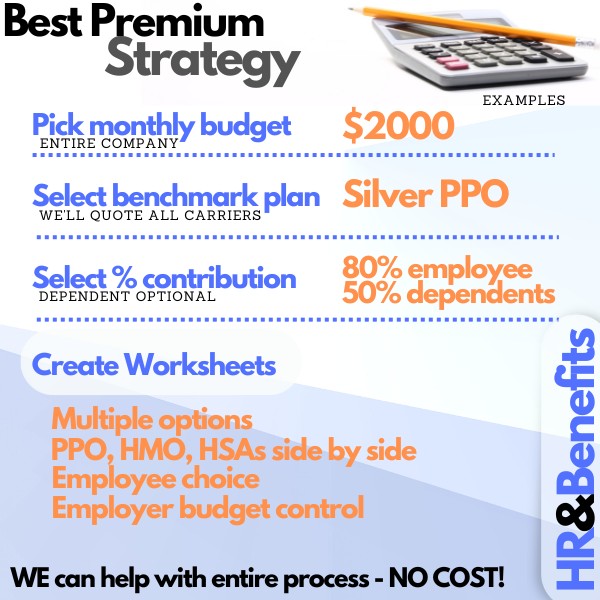

Establishing your monthly budget

There are a few ways to go with this.

You can establish very flexible approaches generally along these lines:

- A fixed dollar amount per employee (and dependents if covered)

- A

fixed percentage towards employees (and dependents if covered)

- A fixed percentage towards a given plan

The latter is the best option.

An example is to pay 75% of the Silver plan for each

employee.

Why is the best option?

It takes into account differences in pricing that results from age.

For example, if you pay $100/employee, that's going to go a long way

further for someone in their 20's than in their 50's.

There's a question of fairness.

75% of the cost however will take this into account.

Ultimately, we establish the percentage and what plan based on your total monthly budget.

We can help with this whole process and it's why we ask for budget in the quote above.

Essentially, we've locked in our monthly budget!

Let's look at what this means for the employee.

Mini cafeteria plan offerings

During enrollment, we will create individual worksheets for each

employee.

On this worksheet, they can see multiple plan options and levels (even HMO and PPO or HSA).

The price for each plan will be based on 75% of the silver level.

This means a bronze (less rich) plan will be much less expensive and gold plan will be more expensive since the contribution is anchored to the silver.

The beauty is that the employee has choice as they would with a larger company (very important) while your budget is fixed to the silver.

Employees can make their own personal choice according to their healthcare needs and budget.

Some employees want the cheapest plan and will opt for the bronze. Others have higher healthcare costs and will opt for a richer plan based on the price difference to them.

We can structure it so that their share is pre-tax (we'll handle this as well).

A carrier may have dozens of plans and even different networks.

When we create the master quote for the employer, we'll pick the best priced options at each level to over the greatest value.

Keep in mind that the carriers don't necessarily have this interest as we see some lesser value plans offered to companies directly.

The networks are also a big deal and we'll help to navigate that

piece.

We don't want to sound like we're selling steak knives but...that's not all!

The bells and whistles with very little cost)

Alongside the core medical plan, we can quote and offer

dental, vision, life, and any add-on needed.

Dental can also have a fixed budget as with medical which makes it

very affordable.

Interestingly, many employees really value dental and vision since they view them as more usable even though the medical protects you from potentially much larger bills.

We can quote all the major carriers including VSP, Delta dental, and

even the embedded options with the medical carrier.

Finally, let's bring it all together and make it faster and easier

for you, the employer.

A seamless system for benefits and payroll (we got it!)

There's been a big push over the last few years to integrate benefits and payroll.

Some companies led with this but they are essentially payroll companies masquerading as benefits experts.

They have very little knowledge of the plans and inner workings of the carrier's to get problems solved (which invariably happen).

Before, you had to pick... an integrated package OR expert

guidance (free) from a knowledgeable broker.

No longer.

We have partnered with Rippling to offer you an online system that's

better than what's available.

You can seamlessly integrate payroll, benefits, and much more in one system where the employee record is tied to each system.

Make a change in benefits? It automatically transfers to payroll or vice versa.

Onboarding and offboarding employees is minutes instead of hours and you still get the knowledge and support of your broker.

Again, the other standalone companies are very limited in how to

strategically get the most out of health benefits for companies.

That's not their wheelhouse.

In fact, we can import the key data directly from Gusto,

Zenefits, and more to make the transfer easy.

Okay...let's wrap.

You can run your quote with the form above. Of course, we're happy to help with any questions at 800-320-6269 or at help@calhealth.net

Our assistance as Certified Covered Ca agents are 100% free to you.

Happy Plan Shopping!