California health

insurance - health insurance for Gig economy

California health

insurance - health insurance for Gig economy

Obamacare Health Insurance For The Gig Economy

You're now part of the ever growing army of self-employed.

It goes by many names whether it's contract, 1099, schedule

C, independent worker...

All the same thing in the eyes of the IRS and when it comes to Obamacare!

There are some big advantages to being self-employed for both

taxes and health insurance.

We'll talk about the latter here and

discuss how taxes now figures into the picture.

We know you're busy.

Being your own boss is...well...busy!

We'll hit the highlights and explain how Obamacare can help you with the health insurance piece of your new work puzzle.

The Sharing economy has changed everything!

Health insurance is along for the ride.

Let's look under the hood.

Obamacare's and Self-Employed people

First, Obamacare is the coloquial term for the Affordable Care Act (ACA for short).

It's the law that changed health insurance significantly.

Especially for the individual/family market.

Many people get health insurance from an employer (group health).

Self-employed people do not have this option.

They are the employer now!

The good news is that Obamacare brought many of the same protections that group enrollees enjoy to the individual/family market and self-employed people.

Good timing!

Let's take the major pieces of Obamacare and explain how they affect the self-employed out there!

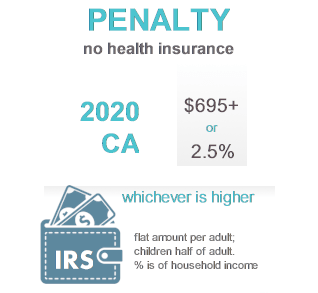

First, the stick - Tax Penalty

A recent study indicated that 40% of Americans may derive their income from the new "Gig Economy" shortly.

That's a huge shift.

All those people will need to get their own health insurance.

Yes, they want to protect themselves from the big catastrophic bills (and occasional weekend sports injury) but also to avoid the penalty.

Yes, penalty.

If you do not have health insurance now, there is a penalty as follows:

That was part of the Obamacare law so that people will

enroll.

If everyone just got coverage when they were sick, the market would explode.

It's a basic tenant of insurance.

So that's the stick.

For self-employed people, the last thing you want to do is get stuck with a big bill in April.

Taxes are already complicated enough.

Who wants a $1000 bill attached; payable to the IRS.

That's no way to run your new business so get out ahead of this.

The way forward is to get an ACA compliant health plan.

Be careful...the various short term plans and questionable plans out there will still leave you with a penalty.

It has to be an ACA plan.

You can run a full list of the ACA plans available here or call us at 800-320-6269:

There's no cost for our services as licensed Health Insurance Agents.

The Obamacare law wasn't all bad cop.

Hello, Mr Good Cop!

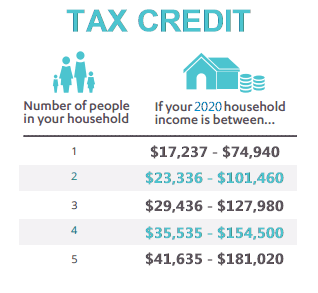

The Tax Credit - Money in Self-Employed Pocket

The law also wanted to provide a carrot to enroll.

It turns out the carrot is even better for self-employed people.

First, a quick lay of the tax credit landscape.

Being self-employed...especially being new at it can be tough on cash flow.

Good news!

The tax credit through Obamacare is provided monthly. It comes right off your health insurance premium bill.

No need to wait for April.

The tax credit is based primarily on household income.

Household is defined as everyone that files together on a 1040 tax form.

Here's where being self-employed gets preferential treatment:

The amount of tax credit is based on income. Roughly the AGI on the 1040 for most people.

That's the Adjusted Gross Income. They back in a few other things: Foreign income, tax free interest, and Social Security.

These don't apply to most self-employed people so the AGI is a good estimate.

We're looking at the current year so prior year income is not a concern.

This can be important for people transitioning to self-employment or 1099 this year.

Why is the AGI so good for self-employed?

For one, it goes based on "net" business income. You're a business by they way...in the eyes of the IRS.

That means your business deductions come off the number.

Awesome!

That can be a huge deal.

Secondly, if you look right above the AGI, you'll see some other deductions.

The bigger ones apply to the self-employed.

Health insurance premium is 100% deductible (up to your net business income amount)!

That's a big subtraction right there!

Half of the self-employment tax also shows as a deduction.

More good good news for 1099 contract workers.

There are other deductions to look at such as tuition fees, moving expenses, and student loan interest.

Anyway, the self-employed are more likely to qualify for the Obamacare tax credit because of the deductions they're allowed to take.

The lower your Adjusted Gross income, the more tax credit you may be eligible for.

What's the easiest way to find out?

You can either run your quote here or call us at 800-320-6269:

There's no charge for our services as Licensed Covered Ca agents and we can quickly size up your income and tax credit situation.

How else do the Obamacare law help self employed?

Just keep reading!!

The individual/family market Finally Grows Up!

There were always big differences between Employer based coverage and Individual Family.

No longer.

The ACA law basically brought most if not all of the protections from the group market to the self-employed.

Now with ACA plans, you can have the following protections:

- No waiting period for pre-existing conditions

- No lifetime or calendar year max benefit

- 100% preventative coverage in-network

- No medical underwriting to enroll

- Rates cannot be increased due to health

- Coverage cannot be declined due to health

- Maternity is mandated on all plans

- Essential health benefits are mandated on all plans

Basically, many of the carve-outs that used to exist are gone.

This was always an issue.

A person wanted to go off on their own and start a business but were afraid to leave their group health plan.

They might be declined due to health. They might be rated up due to health. There could be waiting periods.

This is no longer a concern. Many people who wanted to start their own business (become self-employed) are no longer shackled to a job due to health insurance.

The trade-off for these protections are rules about how and when to enroll.

More on that now!

Obamacare's Enrollment Windows for the Self-Employed

There are now year-end Open Enrollment windows during which we want to apply.

The window generally runs Nov 1st - Jan 31st but check with us as it can change year to year.

There can special triggers (covid, fires, etc) so check with us.

During this time, everyone can enroll and/or change plans.

What if we're outside the Enrollment period?

We need a Special Enrollment trigger:

- Loss of qualified health insurance

- Move that affects coverage options

- Change in family on tax form (marriage, death, birth, divorce)

- Change in status (immigration, legal, incarceration)

Those are the most common.

If you're going contract or self-employed and losing group health coverage, call us right away.

We need one of these triggers in the last 60 days and our effective date is dictated by when we enroll.

Call us at 800-320-6269 or run your gig economy quote here. Our services are 100% free to you.

If you can't enroll right away (no qualifying event), you may need to get Short term health insurance to fill the gap here.

And oh yes....we wish your business all the success in the world!

Exciting times.

Call us at 800-320-6269 and we can go through any questions or run your Obamacare California quote for gig workers here. Thanks!