alternative health

options - Health share

versus Covered California

alternative health

options - Health share

versus Covered California

Health Sharing versus covered california

In California, Covered California dominates the health insurance landscape.

With good reason.

If your income is in the right range, it can means $1000's in tax credits.

We've seen tax credits of 20K+ for couples during open enrollment.

If you don't get a tax credit, that's where it gets difficult.

"Difficult" is an euphemism for crazy expensive.

These days, it's more about people who are unable to enroll in Covered Ca outside of open enrollment OR who need partial month coverage since CoveredCa can only start the 1st of the month following enrollment.

Many people don't even know what health sharing is.

How does it compare to Covered California?

Let's dig in deeper to the differences so we can make a good decision.

You can always jump to the Health Sharing rates here:

We'll cover the following categories here:

- What is Covered California

- What is health sharing

- How to compare Covered Ca and health sharing

- Who Covered California works best for

- Who health sharing works best for

- The tax credit consideration between Covered Ca and health sharing

- Covered Ca versus Health Sharing networks

- Pre-existing conditions with Covered Ca versus health sharing

- Important Final Notes when comparing Covered Ca and health share plans

Let's get started.

Lots to cover.

What is Covered California?

Covered California is a marketplace for health insurance.

It's a way for mainly individuals and families to purchase their own insurance.

It's sometimes called "On Exchange"

Why get coverage through Covered Ca versus "off-exchange"

Tax credits!

If your income is under a certain level (more info on Covered Ca tax credit here), you can get large tax credits to offset the cost.

This is important since the plans, rates, and benefits are (almost) generally identical on or off exchange.

Net net...

If you're eligible for a tax credit

AND

You can enroll (there are special times to enroll)

Covered California probably makes the most sense for you.

We have helped 1000's of Californians navigate the Covered Ca landscape to get the most tax credit.

Call us at 800-320-6269 or run your Covered Ca quote here WITH tax credits included.

What if you don't qualify for a tax credit based on income OR you've missed open enrollment and don't have a special enrollment trigger?

That's where health sharing has become popular.

Let's look at that and then we'll compare the important differences between the two.

What is Health Sharing?

First, health sharing is NOT health insurance

Health sharing plans are memberships where health care costs are shared among their members.

This is new to many people but has become very popular in the last few years.

Why?

Costs!

If you don't qualify for a tax credit, the price of Covered California plans has become very expensive.

Especially if you're older!

People also don't want to get hit with a tax penalty in California.

That's up to 2.5% of your income going to the IRS for not having coverage.

The health sharing plans allow people to get a waiver from the tax penalty and have some level of catastrophic protection for health care costs.

There are 6+ companies that have the tax penalty exemption and OneShare is by far our favorite of the 6.

You can find lots more information here:

Now, let's get into the biggest section.

How to compare Covered Ca and health sharing plans.

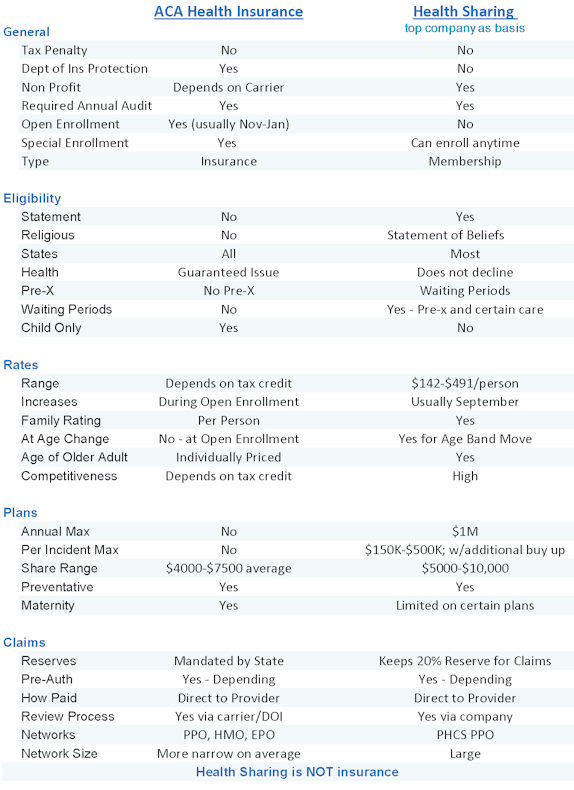

Comparing Health Sharing plans and Covered California

There are big differences between Covered California plans and health sharing.

First, Covered Ca offers ACA compatible plans.

This means, they meet the requirements of the Affordable Care Act or Obamacare.

Health sharing plans do not have these requirements and there are some big differences besides the cost.

Here's a comparison chart between Covered Ca plans and health sharing:

These are the biggest differences between Covered Ca and health sharing to focus on:

- Health sharing is not health insurance and does not have DOI oversight

- Covered Ca plans do not have waiting periods; health sharing does

- Covered Ca has mandated benefits (things it must cover); health sharing does not

- You can enroll in Covered Ca only during Open Enrollment or with a Special Enrollment trigger; Health sharing is year round

- Health sharing plans has waiting periods for pre-existing conditions and certain treatments

Those are some of the big ones.

This topic is really important so we wrote an entire article on health insurance versus health sharing here.

Definitely take a look at it.

Of course, there are always questions and we're happy to walk through them with you.

Who does Covered California work best for?

We can help look at your situation but there are certain people who should definitely go with Covered California if they're able to enroll.

These people benefit from Covered California the most:

- People eligible for a tax credit or Medi-cal based on income

- People with pre-existing conditions or more serious health issues

- People with medication or mental health needs

- People who want richer coverage options

- People considering maternity

This is not an exhaustive list but we're happy to compare your particular situation as we can help with either Covered Ca or health sharing.

You can quote Covered California here:

You can quote Health Sharing plans here:

You can call 800-320-6269 or email help@calhealth.net with any questions.

What about health sharing? Who does that work for?

Who does health sharing plans work best for?

The primary decision driver for health sharing enrollees is cost and/or the ability to enroll in Covered Ca (not in special or open enrollment window).

Combined with tax penalty.

Basically, if you don't qualify for a tax credit, the Covered California plans have become unaffordable for many people.

This is really true for older Californians.

We see couples in their 50's or 60's where the Bronze plan is $1800-2000/month.

The couple may make income which puts them just outside the tax credit limit.

For most people, paying $25K in health insurance premium on total income of $100K isn't really an option.

They also don't want to just throw away over $2000 in tax penalty at tax filing time.

This is where we see a lot of health sharing enquiries.

Make sure to run your Covered Ca quote though as there may be changes to this rule that gives you more tax credit.

There are other considerations although 1/3rd of your income going to health insurance makes some of the points moot.

People who might benefit from health sharing plans versus Covered California:

- Older Californian individuals where health premium is too high

- Californians not eligible for a tax credit

- Californians in good health

- Californians without significant pre-existing conditions

- People looking for more catastrophic coverage

- Californians looking to avoid a more significant penalty

Again, make sure to look at our health insurance versus health sharing article for greater detail.

Covered California plans are ACA compatible so they make up what is "health insurance" on the current market.

We're comparing AlieraCare standard plans since they are the most competitive in that market segment (and safest).

Really, it's become a question of affordability.

For some people, the ACA plans are completely out of the question in terms of cost.

That brings us to the next section...

The tax credit difference between Covered California and health sharing plans

This is really the key factor.

If you can qualify for a tax credit based on income, Covered California will likely be the way to go.

There are situations where the tax credit is very small (especially for young people) but otherwise, we generally a great deal of help.

The Covered California tax credit is based on the following:

- Income estimate for the current year (next April's tax filing)

- Size of household (# of people that file together on one 1040 tax form whether enrolling or not)

You can find more information on the Covered Ca tax credit here or just

run your quote here:

You'll see the tax credit info above if you entered your income.

If your income/household situation is more complicated or in flux, check with us.

There's no cost for our services and we are Certified Covered California agents.

Call 800-320-6269 or email at help@calhealth.net

If you will not qualify for a tax credit, then we may want to consider health sharing depending on the following criteria:

- Age (which drives costs)

- Health status

- Pre-existing conditions

- Maternity

- Mental health needs

- Prescription needs

These are some of the bigger differences between Covered Ca and health sharing.

We're happy to walk through the differences with you.

Covered California versus Health Sharing Networks

This is actually a plus for health sharing which is pretty amazing.

The networks for Covered California have continued to shrink in terms of size and flexibility.

It all started in 2014.

The new Covered Ca networks were about 2/3rds the size of the old PPO and HMO networks.

Even within a given carrier!

It was probably the biggest problem with the rollout.

We used to have PPO's in every area and from multiple carriers.

That's not the case anymore.

PPO's became EPOs. Which then became HMOs.

Carriers left areas or the State entirely.

It's a problem.

We're hoping it will improve with time for ACA plans.

What about health sharing?

OneShare has a PPO through PHCS or Multiplan which is extensive and Nationwide.

You can check out the Covered Ca doctor networks through the quote here:

Under any given plan, there will be a Provider Search box.

You can check out the OneShare PPO network here.

We're happy to help with any questions.

Waiting Periods and pre-existing condition differences between Covered Ca and health sharing

This is an important distinction.

Covered Ca does not have waiting periods for pre-existing conditions or other services.

OneShare will have waiting periods for pre-existing conditions and some specific health care needs right away.

You have to be on the plan for a period of time before it can pay out for certain healthcare needs.

It's best to read the member's guide which we make available to everyone for more detail on how this works.

Net net...

If you have health issues and qualify for a tax credit, health sharing plans will probably not be the right plan for you.

We're happy to help you analyze these two options at 800-320-6269 or by email at help@calhealth.net

How to Compare Covered California and health sharing Key Points

We've covered a lot.

Here are the critical pieces to look at when comparing the two options:

- Tax credit eligibility with Covered Ca

- Health and Pre-existing conditions

- Monthly cost difference

- Certain medical needs such as maternity, mental health, and prescriptions.

Those are key concerns when analyzing the two.

In the end, Covered California might be unaffordable if you do not qualify for the tax credit.

That tends to drive the decision one way or the other for most people.

We have written extensively to help people understand with these articles:

- Obamacare versus health sharing

- OneShare plans, rates, and introduction

- Best health sharing plans

- Health sharing comparison.

Of course, we're happy to help with any questions at 800-320-6269 or by email.

You can quote the health sharing plan:

This is new to many people so please let us know how we can help.

You can check out the

health share rates

here.

Also, our Guide is in-depth on how health sharing work. Great resource to educate yourself.

You can run your Health Sharing plan Quote to view rates and plans

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!