California health insurance - accidental health insurance

Personal Accidental Health Insurance - Is It Worth It?

Lots of people are really healthy.

They eat well.

They exercise.

We're going as far as Yoga, mind you.

Typically, when we speak with those people, they really want to just cover accidents and injury.

Big ticket items.

The subject of accidental health insurance usually comes up.

So...

What is accidental health insurance for individuals and maybe more importantly...

Is it worth it?

Great question.

Let's get started.

You can always run your quote right away here:

Otherwise, feel free to jump to any section here:

- What does accidental insurance mean

- How does accidental health insurance work

- What does accidental health insurance cover

- What are the main accidental health insurance companies

- Which is the best accidental health insurance carrier and plan

- Accidental insurance versus health insurance

- Is accidental health insurance worth it?

- Accidental health insurance premiums and quotes

- How to enroll in accidental health insurance

Let's jump right into it.

What does accidental insurance mean

Accident insurance is a policy that pays you money directly if you have one of the covered accidents.

Pretty straight forward but there are some important aspects there.

First, the carrier pays you in cash directly.

Not to the doctor or hospital.

To you!

This speaks to the most common use of it now...as supplemental insurance for high deductible insurance plans!

We'll talk about this later when we strategize on how to best use accident health insurance.

Each carrier will have a list of eligible triggers for the policy to pay out.

These tend to be pretty comparable but it's important to review.

Also, keep in mind that only accident and injury can trigger the policy.

Illness (such as Cancer or Stroke) will not!

There's a way to address this with one of the most popular plans out there (more later).

How does accidental health insurance work

Let's look at an example:

Let's say you have a $5000 Balance plan with BCBS.

You're going about your day and take a bike ride.

Turning a corner, you misjudge an oncoming car and you swerve.

Unfortunately, you land and break your wrist.

You may not ride bikes but you can see there's a million ways to have similar injuries.

Once submitted to the carrier, the insurance company will pay you a predetermined amount in cash.

Directly to you.

That's accidental health insurance in the works!

So...what specific accidents and injuries will trigger the benefits?

What does accidental health insurance cover

Every carrier will have subtle takes on what is covered.

We'll use the popular Balance plan with IHC (partnered with BCBS)

Sample verbiage from certificate of coverage regarding accidental health benefit trigger:

We will pay benefits for Covered Charges incurred by an Insured Person due

to Injury. A Covered Charge is considered incurred on the date the treatment or

service is rendered or the supply is furnished. Covered Charges are payable only

for an Injury for which the first treatment or service is incurred within the

Initial Treatment Period and for which expense for all treatment or service is

incurred within the Benefit Period. No benefits are available beyond the Benefit

Period.

After the Deductible, if any, has been satisfied, We will pay the Benefit Amount

of incurred Covered Charges up to the Maximum Benefit Amount, Per Injury.

Benefit payment is subject to the definitions, limitations, exclusions and other

provisions of this Certificate.

So what does it all mean?

Basically, if you have an injury that meets the basic requirements, it's good to reason the plan will pay.

We generally don't see many issues with this part of the policy.

Pre-existing issues (re-injuring a knee after ACL) would be an issue but new injuries are pretty straight forwar.

You can request a copy of the Certificate from us by email.

What are the main accidental health insurance companies

Here's a list of companies that offer personal critical illness health insurance:

- IHC (partnered with Blue Cross Blue Shield)

- UnitedOne

- AFLAC

- National General

- Cigna

These carriers all offer individual or personal accidental insurance which is an important distinction.

There are also employer based plans and a different policy altogether tied in with life insurance policies.

The carriers listed above offer a plan that you can purchase for yourself and dependents that will work the way we described above.

So...which is the best one?

Which is the best accidental health insurance carrier and plan

We actually have some strong carriers in this space and they two of them definitely have strong chops in the health insurance market which is important.

You're dealing with medical issues and codes.

Health insurance carriers have the experience and systems to handle this best.

You definitely want that when dealing with claims.

They're also used to working much faster than life insurance carriers.

So that's one aspect to consider and leaves us with two strong frontrunners:

- IHC (BCBS partner) and UnitedOne.

Here's where things get interesting.

If we have to make a decision, we would actually choose by plan!

IHC has a plan called Balance which offers Accidental Health and Critical Illness together!!

That's the way to go.

Rather than have two policies, the Balance plan smartly combines the two into one policy.

It adds in a little big of income protection and and some other perks but here's the deal.

We don't want to have to guess whether we might get cancer or a broken leg.

One policy to cover either is the way to go.

You can quote the Balance plan here:

We're happy to help with any questions and there's no cost for our assistance.

Zero!

Just call us at 800-320-6269 or email.

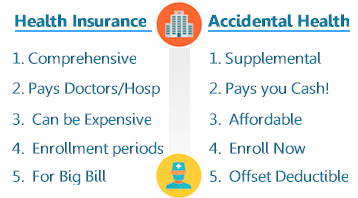

Accidental insurance versus health insurance

We get calls all the time with a simple question...

Should I get Accidental insurance or health insurance?

Unfortunately, that's comparing apples and oranges.

Many agents out there have been pushing accidental health and critical illness as an alternative to ACA (Obamacare) health plans.

They're doing a disservice.

It's important to understand the difference.

Critical illness and accidental medical (like the Balance plan) are designed to supplement health insurance.

Not replace it!

Here's the issue.

The real reason we buy health insurance is for the big bill.

People like to focus on the copays for office visits and rx since they're most likely to use those.

It's the $50K or $100K bill with the hospital that's the real concern.

Traditional health insurance is really there to cover that!

The Accidental health plans are not designed for that.

Sure, they'll offset some of the cost.

They're really used to offset your out of pocket cost!

For example, let's say we have an accident and we rack up $50K in expenses.

Very easy by the way...1 night in the hospital!

If we have a Bronze high deductible ACA health plan, we may be on the hook for $7K.

That's the typical max out of pocket on today's market.

This is where people really get hit hard.

They have health insurance but they can still be out of pocket $7K.

That's per person!

Keep in mind that there can be high max out of pockets for Bronze, Silver, and Gold!

This is also becoming the case for Employer health plans.

There's a huge shift towards high deductible plans for employees now.

Accidental health plans are designed to supplement health insurance.

Some people will get them instead of health insurance.

We understand if they can't afford full health insurance...it's ridiculously expensive.

Just be aware of the back-end exposure for big bills!

A good strategy is to go with the lowest priced full plan and use Accidental to supplement it.

You can quote that option here:

Of course, we're happy to help with accidental or full health insurance.

Is accidental health insurance worth it?

This is really the question, right?!?

Is it worth the money!

Here's how we analyze based on our 7 year itch (accident).

On average, a person has a major health care incident every 7 years.

We can get $5K of protection for about $500/year.

So our expected payback period is about 10 years.

That means that if we have a major use of our accidental health policy within 10 years, we break even.

But we're estimating every 7 years!

In that case, accidental health pencils out on average.

It means we can average about a 30% return (7 years payback versus 10 break even).

We especially like when it's a comprehensive policy that covers accidental health and critical illness like the Balance plan (more info here).

This is one reason the accidental health policies are so popular right now.

Really since 2014 when the market basically forced most people into plans with

high max out of pockets.

The value only increases if we have multiple family members on one policy.

Let's look at the rates.

How to quote Accidental health plan coverage

You can quickly quote the rates for Accidental health and Critical Illness

here:

The rates are pretty simple and we're happy to help with any questions!

How to enroll in accidental health insurance

Enrollment is also very easy.

You can enroll right through the quote tool above.

Accidental health plans have a simplified application.

Much easier than the old health insurance applications of old.

Make sure to answer fully and let us know if any questions come up.

Wrap on Accidental health plans

Since 2014, the popularity of these plans has exploded!

This will continue as long as we see:

- Increasing health insurance rates

- Large deductibles and max out of pockets

If you can save $100/month by taking a high deductible option and get accidental health for about $40/month, that's a good trade-off.

You're saving $700/year right off the bat!

Many people are making this same calculation.

We're happy to help with any questions at 800-320-6269 or by email.

There's no cost for our assistance!

You can run your Accidental Medical insurance to view rates and plans

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!