California health insurance -

Covered California - Tax

Credit

California health insurance -

Covered California - Tax

Credit

Covered California Tax Credit

IMPORTANT UPDATE - Get updated info for Tax Credit here.

It's never been more important!

Let's look what to expect in 2017 for tax credits to help pay for insurance premium.

More importantly, let's find out why it's 13% more important than in 2016!

The rates are going up but the tax credit may just be the savior for millions of Californians.

Many are still not taking advantage of what is essentially free money.

Many of these people don't even realize they qualify.

Let's look at the basics for 2017 and also...

Look at the main reasons people miss out on tax credits that average $1000's per year.

You can always run your quote here:

2017 Tax Credits...only the facts Mam!

First, let's look at the basics.

You get the money now!

The tax credit is officially called an "Advanced Tax Credit"

This means that you do not need to wait for tax filing time.

You get the credit monthly and it's automatically reduced from your health insurance premium.

That's great news!

You can choose to take it in April but almost know one does.

You might do this if you're not sure of your income estimate for the year.

The tax credit is based on income estimate for 2017 (more of this later).

If your income comes in much higher than you expected, you may have to pay back the premium at tax time.

No one wants this.

Conversely, if you're owed more tax credit, you will get that in April.

If you need more detail on how the tax credit works, call 800-320-6269 for our free service as Certified Covered Ca agents.

Okay...so how do you qualify?

Who is eligible for 2017 tax credit?

Millions of Californians!

We're not kidding.

The tax credit is based on income.

You want to look at your best estimate for Modified Adjusted Gross Income (roughly line 37 on the 1040 for most people).

The 1040 tax form is your best friend in this calculation.

For example, Covered Ca's definition of "household" is everyone that files together on a 1040 tax form.

You also need to be a U.S. Citizen or have legal status (Green card, etc).

You cannot be incarcerated, eligible for Medicare, or offered Affordable group health insurance (more on that later).

As Certified Covered Ca agents, call us at 800-320-6269 or run your instant Covered Ca quote here. Our services are free to you and we've enrolled 1000's of Californians with tax credit.

Those are the big sticklers.

Since household size is so important, you'll notice that bigger families of 4 or more have an advantage.

Now...the major reason people DON'T GET the tax credit they're eligible for....income estimate.

The income estimate dilemma

This piece is the hardest and yet, most important.

How much you will receive in 2017 or whether you'll receive anything is dependent on income.

For many people, estimating out a full year is nearly impossible.

We want the line 37 submitted in April of 2018!

Self-employed people especially have trouble here.

And they have the most to gain!

Many self-employed people think of their "gross income" or even their business income.

There are other deductions they can take from line 23-35 of the 1040.

Health insurance premium. 1/2 of self-employment tax. Ect!

We can help you really fine-tune this amount down.

One note...the "modified" part of Modified Adjusted Gross Income means that you add back in:

- tax-free interest

- foreign income

- social security income

Social Security is the big one people forget about.

Disability is a little trickier and it's probably good to discuss your specific situation at 800-320-6269.

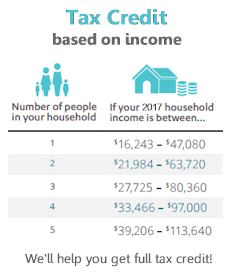

Income levels for 2017 tax credit

The tax credit is on a sliding scale based on income.

As your income goes down, your tax credit goes up until you hit the minimum floor.

At that point, you may be eligible for Medi-cal which is low or no-cost insurance through the State.

There are pro's and con's here which we're happy to discuss.

One note...children under age 19 have a higher income threshold for Medi-cal.

It's not uncommon for the adults to qualify for tax credits and the standard plans while dependent children qualify for Medi-cal.

We can discuss the options available in that case. You can still get the standard plans (say because you want to keep a doctor) but without a tax credit.

We can help you process that transaction as it's a little tricky within Covered Ca. Just call 800-320-6269.

The income levels are based on the Federal Poverty Level which goes up each year.

Here's the rough guide for 2017:

Beyond the max income, there is no tax

credit.

If you're straddling either the minimum (cross into Medi-cal) or the max, call us for options at 800-320-6269 or run your 2017 health quote here.

We can help you fine tune the estimate for your desired outcome.

Tax credits...but wait, there's more!

As your income estimate goes down, we also may qualify for "Enhanced Benefit Sharing".

The enhanced Silver plans!

This is a huge deal and most people don't know about them.

Basically, you'll get richer benefits for the same price of the normal Silver plan.

There are three flavors:

- Silver 73

- Silver 87

- Silver 94

The Silver 87 and 94 are really rich plans... equivalent to the Gold or Platinum level!

If you're right on the cusp income wise, we can help you make sure we're using the correct amounts.

Many people use incorrect income estimates and end up missing out on the Enhanced Silver plans.

A huge loss that they're not even aware of!

Call us and we'll discuss where the different Silver plans start.

We always look at these breaks if we're close to make sure people get the best options for them.

Our services are free as Certified Covered Ca agents. Call 800-320-6269 or run your 2017 Covered Ca quote here.

Some Gotcha's with the 2017 Tax Credit

Here are some of the many "Gotchas" we see while enrolling people.

Self-enrollment

It's sounds silly but roughly 50% of the people we help who have self-enrolled get the wrong result in terms of tax credit.

We're not surprised. If you answer one of many questions incorrectly (easy to do), poof...tax credit goes away.

We can enroll you in 5 minutes by phone and make sure this doesn't happen.

Married status

If you're legally married, you must file jointly to get the tax credit. No way around that.

Affordable group coverage

This one is tricky. If you are offered ACA coverage from an employer and your share of the cost for just YOURSELF does not exceed 9.5% of your gross income, you and/or your spouse cannot get a tax credit.

That's a huge one and many people have no idea about the rule.

The IRS is now asking companies to provide info on employees they "offer" coverage to. They'll cross-reference against people receiving tax credits and BAM!

You may have to pay back all the tax credit in April.

Avoid this at any cost.

The whole "affordable" group health coverage question is tricky, confusing. and a mess.

Call us at 800-320-6269 to go over your situation. We'll try to see if we can avoid the issue.

Those are the big ones but there are many little Gotchas. We'll help you avoid them.

You can access the online application here:

2017 Tax Credit Wrap-up

The rates are going up 13% for 2017 on average.

If you're eligible for the tax credit, your tax credit will also go up to offset the increase.

Make sure to get the most credit you're allowed.

It's literally $1000's per year.

Our services are free and all we do is help people navigate the Covered Ca enrollment system.

We have enrolled 1000's of Californian's in their system with an average time of 5 minutes by phone.

It will save you about 45 minutes to 1 hour and more importantly, it might just save you $1000's in tax credits.

Call 800-320-6269 or run your 2017 Covered Ca health quote here.

How can we help you get the most tax credit in 2017??

2017 Covered California Quote with Tax

Credits

to view rates and plans side by side from the major carriers...Free.

Again, there is absolutely no cost to you for our services. Call 800-320-6269 Today!