California Medicare Options - How do I compare the different medigap plans

How to Really Compare what Medicare Supplements cover in California

It's all so confusing if you're new to Medicare. Different letters. Different rules.

We're going to take the whole medigap process and make it so simple that you'll feel incredibly empowered.

25+ years of California medigap experience laid bare and our Google reviews worn proudly:

Where many comparisons will coat language in very generic terms, we're going to

get super specific and really look at what matters.

10,000+ conversations boiled down in a few simple rules. Yes, it's that easy.

Hopefully, you'll then work with us since there's no cost for our assistance and we offer free, online quoting and enrollment. Plus all the hand-holding you could possible want. At no cost.

So...here are the topics we'll cover:

- Understanding the real reason for medigap

- Medigap versus Advantage plans; why you're here

- Sizing up the different medigap plans

- Understanding the carriers and networks

- Running a sample medigap quote

- Now, run your personalized medigap quote

- The part D question for medication

- Enroll online fast and free

Let's get started. You'll know most of what you need to make a good decision after this 10 minutes. And you may save quite a bit of money!

Understanding the real reason for medigap

First, why even get a medicare supplement? Why not just go with traditional medicare alone?

Cut to the chase...

It's the 20% coinsurance that you have to pay...there's no cap to it!

If you get a $20K bill, that's $4,000 you'll have to pay.

"Yea, but I'm in perfect health. I never see the doctor".

This is the wrong time to take that gamble. Health care costs double with every decade and we're seeing accidents or surgeries that run 100's of thousands to people who are "perfectly healthy".

Don't take our word for it:

And the trajectory is even worse:

There are cheap ways to cap the back end 20%.

Let's first discuss the two big options to put a ceiling on our exposure.

Medigap versus Advantage plans; why you're here

Here's the skinny:

Advantage plans are mainly HMO with low/no cost but more exposure when you get sick or hurt and more restriction on who you can see and how that care is handled.

It's an HMO after all!

Medigap plans are more similar to PPOs where you can see any provider that takes medicare (most) and care is less managed.

People generally know if they like HMO or PPOs from prior coverage.

We have big reviews on how to compare Advantage and Medigap or what's the trade-off with Advantage plans.

We can work with either for you!

Net net...do you want to pay a little more for more control and access to more doctors

The real question is...

Do you live in an area where the max-out-of-pocket is under $1000 with Advantage plans?

That's basically greater Los Angeles (Orange, Riv, etc).

In other areas like the Bay Area or San Diego, the out-of-pocket max can be around $2-3K/year.

This really makes Advantage plans less...advantageous compared to medigap plans.

Remember...this is a bad time to assume you won't have healthcare costs!

So...let's assume you're leaning to the medigap side of things...more providers and more control.

How do we compare those plans?

Sizing up the different medigap plans

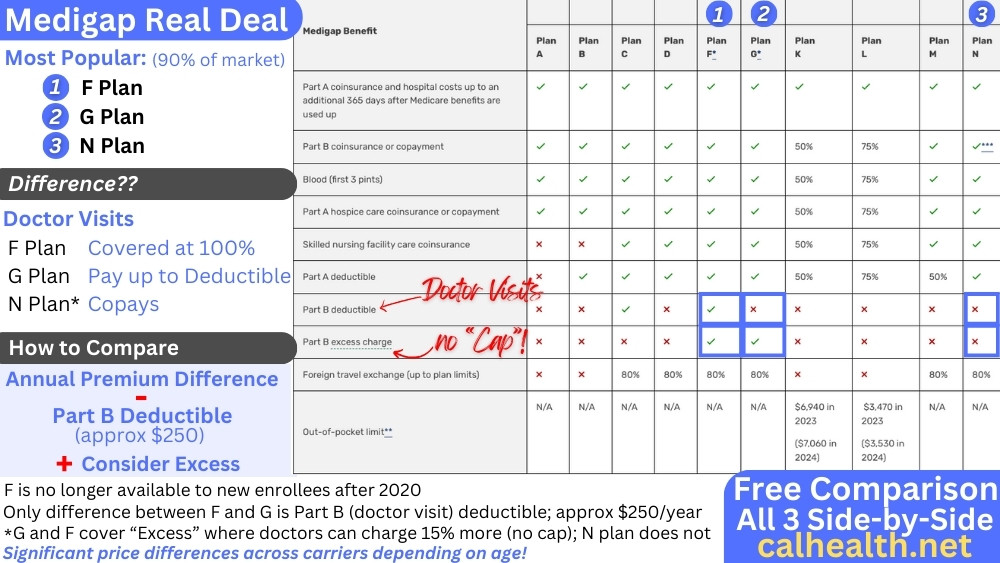

There's a slew of medigap plans on the market. Here's the broad strokes (don't worry, we'll zero in on the ones that matter):

So, let's make this easy.

Here's the breakdown for most recent year (2020) California enrollment by plan type per the NAIC:

According to this report, the most popular Medigap plans in California in 2019 were Plan F (36%), Plan G (25%), and Plan N (16%).

The F plan is no longer available to new enrollees (since 2020).

The most popular current plan is the G plan.

It covers all the major holes of medicare except for the part B (doctor) deductible of just over $240/year. That Part B loss is the only difference between G and the old F plan.

This is the richest plans available to new members.

The key is that it covers Medicare Excess, which allows providers to charge 15% above what Medicare allows.

This 15% isn't capped (like the 20% above) so we want it covered. Only the G and C plan cover it and C is not as readily available.

So, G is the most popular!

You can reduce the monthly cost with the G high deductible plan.

Outside of the G, the N plan is the next runner up.

The N plan is interesting. It builds in a copay for office visits and a separate one for emergency room visits that you'll pay.

It DOES NOT cover excess which is our big issue with it.

There's going to be more and more budget pressure on Medicare and the doctors will get squeezed judging by how the ACA (Obamacare) looked to extract its pound of flesh.

The doctors got hammered. Not so much for hospitals and RX.

We want the 15% Medicare Excess covered because there's no cap and the future points to more doctors HAVING to charge this just to stay in business.

So...G or G high deductible become our favorites even though the N plan is tempting (till you undestand you may be on the hook for $1000+ via excess).

So...we have:

- G

- G high deductible

- N plan

There are some stragglers sprinkled among the A (just basic 20% coinsurance), and the new K and L plans.

The last two build in cost-sharing up to a max-out-of pocket but those numbers are high (almost $7K and $3500).

Again...bad time to take this risk. Carriers love it! (think of them as the house with Black Jack).

Alright...we're probably at the G plan or maybe the N or A plan if you really want barebones and exposure for the Excess uncapped risk.

Let's now address the next question?

Understanding the carriers and networks

Here's the beauty of the medigap world.

They all have the EXACT SAME network of providers.

Basically, any doctor or facility that accepts Medicare. Nationwide. Yes, you can see providers in other States. Or across California.

What about the carriers?

The medigap benefits are standardized! This means that a G plan is the same from one carrier to another.

Some may have little add-on benefits (like the G extra) but the core plan is the same. The grid above.

That makes it real easy to compare.

Over the past 10 years, the dominant California medicap carriers have been:

- Blue Shield of California

- Anthem Blue Cross (separate carrier from Blue Shield)

- United Health (AARP)

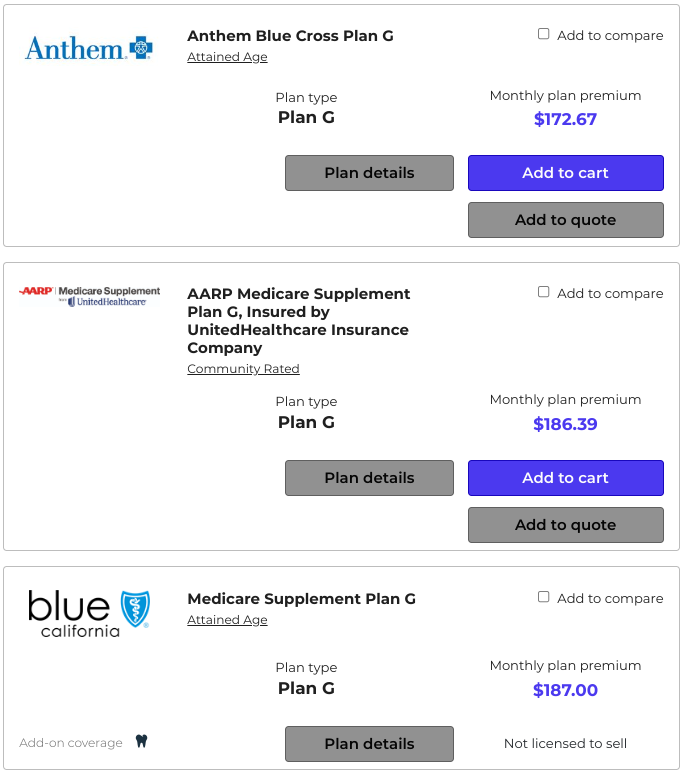

Within a given area and age (the two drivers of cost), Shield has been priced best for the most popular G plan.

Anthem usually follows (sometimes is cheaper) and United Health (AARP) is third.

Health Net or other carriers occasionally get close but rarely have the best pricing.

You'll be able to quote all of them side by side.

So...let's run a sample quote to break it down below.

We'll look at age 66 in Los Angeles.

Running a sample medigap quote

So...let's start with the G plan (no first year discount like with Shield):

Just like we thought. In this case, Anthem is priced best.

LA is more expensive than other counties so make sure to run your quote below.

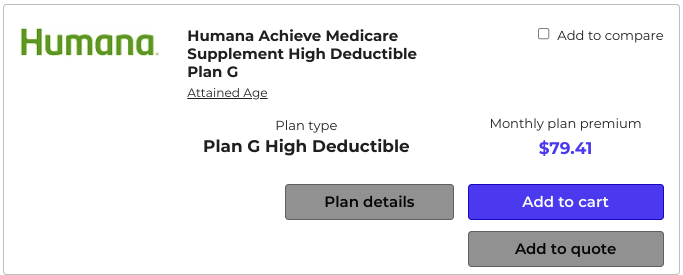

What about the G plan high deductible?

Okay, so we're saving about $100/monthly ($1200/year) to take on a deductible of

$2700.

Not terrible if you're in really good health. Just know that on average, at 65+, this is eventually going to bite you (or they wouldn't offer it on the market).

The real way to read that? Expect to pay about $1500 on average out of pocket. The carriers price the plan based on claims experience and we can subtract the $1200 savings from the $2700 exposure.

Now you're an insurance pro with equal footing to the carriers!

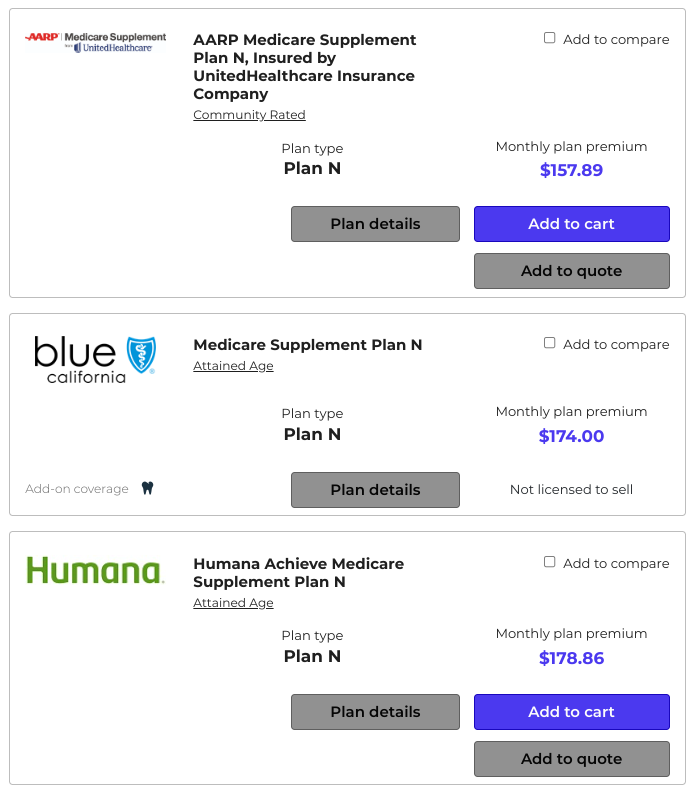

What about the N plan?

United Health (AARP) is the leader here in Los Angeles.

So about $15 savings per month (versus the G plan) and we're paying copays instead of the Part B deductible ($250+) so probably a wash for the average person there.

The issue is that the N plan doesn't cover Medicare Excess.

There's no cap for this 15% if your doctors charge it. We don't like uncapped risk! It's whole reason we have medicap to begin with!

We're happy to walk through your situation with you to see how it all settles out! Just email us at help@calhealth.net (just need date of birth and zip code).

Or...run your free and instant quote right below!

Now, run your personalized medigap quote

You can quote the major medigap carriers and plans here:

Just enter date of birth and zip code to pull up all major plans.

You can filter on the left for type of plan (G for example) and/or carrier.

The Medigap plans are on the 4th tab over up-top.

We're happy to walk through any and all questions. Again, our Google reviews:

Speaking of tabs up top... What about Part D for medication (which is not covered by medigap plans).

The part D question for medication

You'll notice the 3rd tab over is "Prescription Drug Plans" or Part D as it's known.

We have a whole review on Part D but this rounds out your decision making.

- Medicare Part A and B (B requires a separate monthly premium)

- Medigap plan (like the G above)

- Part D for medication

The Part D carrier can (and likely will) be different from the medigap plan.

For example, Aetna's SilverScripts has been a market leader for Part D but not as strong for medigap in California.

You can have a supplement with Shield and a Part D with Aetna if that works to your advantage.

Now, let's talk about the best part.

Enroll online fast and free

Right from the quote system we'll send you, you can enroll for major carriers all online and free!

This is true for medigap, advantage, and/or Part D plans.

You'll see an "Add to Cart" next to the plan of choice and reach out to us with any questions on the application process.

Here's the best part.

At Annual Open Enrollment (end of the year), our free system allows you to update info (doctors/RX, basic info), plus quote/switch plans if you find a better option.

This reduces the time and effort by about 80%!! From roughly 45 minutes down to 10!

There's no cost for this system and we're happy to help with any questions.

Now...you're a medigap pro!