California Medicare Options - Compare Giveback Advantage plans in California

How to Compare the California Giveback Advantage Plans?

The Medicare Advantage plan market is very competitive and dynamic...especially in markets like Los Angeles.

With the pandemic, there's been a new entry into the market and it quickly became very popular.

The rebate or giveback plans!

There can be a way to do this well but there's also a way to really take on a lot of risk that many people don't understand.

First, our credentials:

We'll compare the different Part B giveback options and shed light on how to separate the good, bad, and truly ugly!

Here are the areas we'll cover:

- What are the Part B Giveback or Rebate Advantage Plans

- How to compare and pick the best giveback plan

- A sample quote for giveback plans in Los Angeles area

- How to quote your giveback plans

- How to enroll in a giveback Advantage plans

Let's get started!

What are the Part B Giveback or Rebate Advantage Plans

As seniors, we're all well too aware that there's a monthly premium to pay for Part B.

This payment is either deducted from social security or we actually cut a check for the amount.

It's optional but without it, we're taking on exposure for physician costs which can quickly rack up 10's of $1000's in costs for more serious issues.

Not worth the risk especially if we can cap the exposure at no monthly cost with Advantage plans or even look at high deductible medicare supplements.

The standard Part B premium is just above $174 but the actual amount can go up or down depending on our income.

So, what's the Giveback Advantage plan?

These plans came on the scene with the added benefit that they would return or rebate a certain amount of money towards your Part B premium.

This money doesn't come directly to you but reduces the Part B bill due on a monthly basis.

The giveback or rebate is an additional benefit above and beyond the standard Advantage plan benefits (which must meet the basics of traditional Medicare - see Advantage versus Medicare alone).

This all sounds good so is there a catch?

Let's dig deeper.

How to compare and pick the best giveback plan

Throughout our reviews of Advantage plans (Insider's

Guide to Advantage or

How to Compare

Advantage plans), we talk about the Triple Threat:

- Low or no cost

- Out-of-pocket-max under $1000

- Star Ratings of 4+

If we can hit these WITH a Part B giveback then...great!

The problem is that many plans will adjust the out-of-pocket-max or other key benefits.

To us, the max is the big deal.

For example, if a carrier is offering the following:

- Advantage plan without rebate: out of pocket max - $800

- Advantage plan WITH rebate: out of pocket max - $2500

That's not uncommon!

The rebate may be any amount from $50/month or more.

Let's say it's $50/month or $600/year for our example.

So...we're going to save a guaranteed $600/year but risk $1700 on the backend if we get sick or hurt.

We're not fans of that gamble. Why?

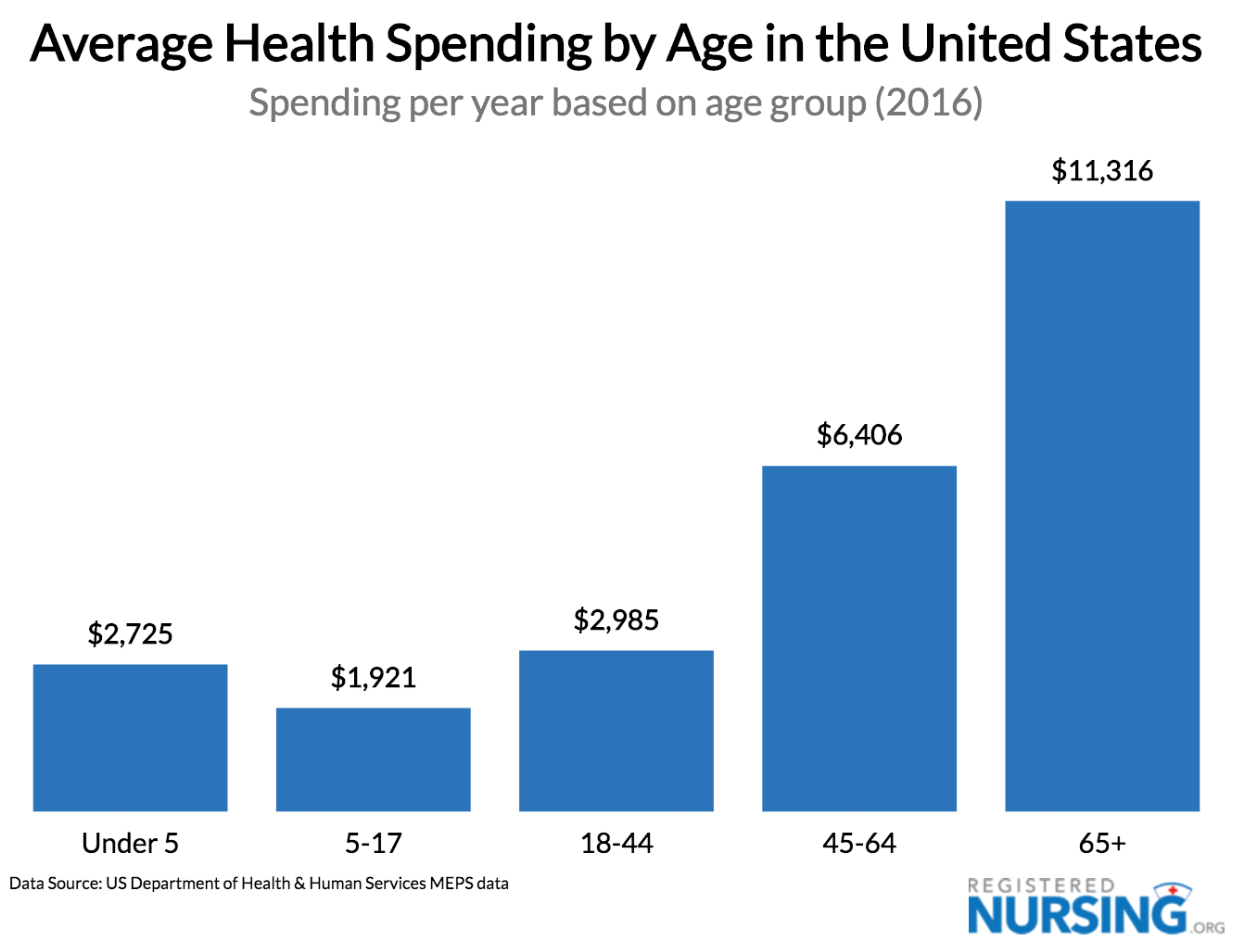

There's no worst time in your life to bet you'll have low medical expenses than at 65+!

The carriers aren't stupid and they know this. In fact, they have the actuarial tables that show expected medical costs and there's a reason that $2500 is there.

It didn't just come out of thin air! Otherwise, they would compete with the other carriers and drop it to a lower amount to gain more marketshare!

That's the nature of the business and we're giving you the keys to the kingdom (in terms of understanding).

So...the question is this:

Can get a Part B rebate or Giveback AND keep our out-of-pocket-max low?

Maybe.

Let's run a sample quote in the LA area to see how to find this righteous combination!

A sample quote for giveback plans in Los Angeles area

Your results may differ but In the quote, when we filter for "part B giveback" (left side, half way down), we get the following:

Okay.

First, look at the Star Rating. United and Humana both have 4 star in this example. That's a good start.

They all have zero premium.

Is the out of pocket max!

- United: $800

- Humana: $2500

- Wellcare: $2500

Exactly like the situation we described above where were saving on the Part B premium but taking on quite a bit more risk on the back end.

However, with United's plan, we can have our cake and eat it too!

Even better, they have the biggest provider network which is critical with Advantage plans.

Even UCLA and Cedars are showing up which is very impressive.

Now you know how to compare the California Part B Giveback plans and not taken to the wood shed!

Enough with examples, let's look at your specific situation.

How to quote your giveback plans

So...what about your area?

Keep in mind that in a given area, it can be hard to hit all our targets above.

For example, in the Bay Area or San Diego, the max out of pockets are generally higher anyway.

This reflects less populous areas (than LA) and also stronger providers which can negotiated harder with carriers.

You need lots of people to make HMOs work well (Advantage plans are mainly HMO).

So...run your quote here:

Click on "see giveback plans" in the filter and focus on the three

criteria:

- Star Rating (can differ by plan within the same carrier)

- Monthly premium (usually pretty easy to hit zero cost)

- Out of pocket max under $1000

The last point is where the rubber hits the road in this comparison.

Make to enter following into the Preferences area:

- Doctors/hospitals

- Medications and dosages

- Preferred Pharmacy

Sort by "Total Estimate Cost" up top so it takes into account your medication costs.

You have to then compare that max versus the standard plans (unclick see rebate plans) to see if there's a big difference.

Of course, we're happy to help with any questions or to run this quote for you at help@calhealth.net

Check out our Google Reviews:

Make sure to enter your doctor and medication info so that the system ranks the plans according to works with your providers and RX.

This addresses complaint #1 and 2 with Advantage plans.

What if you find one you like?

How to enroll in a giveback Advantage plans

This is even easier.

We contract with the major carriers that work with independent doctors/medical groups.

For example, if you like the United giveback plan above, just click on Add to Cart in the quote and you can enroll online!

It's fast, secure, and free to use! The whole quote/enroll system is 100% free to you and that includes any assistance from us!

Here's the best part.

At Annual Open Enrollment each year, you just update meds, doctor preferences, and basic info to the existing account.

Voila! You can quickly quote, compare, and enroll with most of the work already done!

Of course, we're happy to help with any questions and walk you through the process. Reach out to help@calhealth.net with any questions or to set up a time to talk. No cost for our assistance!