California health insurance

-

5 Ways for Businesses to Save

California health insurance

-

5 Ways for Businesses to Save

Five Ways to Save on Business Health (that most Companies don't know about)

The group health market has completely changed in the last few years and more is to come.

Much more.

If you have a group health benefits plan or need to get one to avoid new penalties or attract the best employees, keep reading.

The status quo (not shopping new options) can cost you $1000's each month. Let's avoid that with the following five keys.

Tax

Credits through Covered California for Business

Tax

Credits through Covered California for Business

There are new tax credits available to small business for health insurance.

If you qualify, it's a big deal.

Covered Ca might pay up to 50% of your employee premium.

We are helping companies get 1000's of immediate tax credit towards their employee health premium NOW.

This is found money if you qualify and to not accept or worse yet, not know about it, is writing a check to the IRS monthly.

This is especially important since the IRS finally clarified that a very large tax penalty will hit companies that pay for their employee's individual/family health plans.

That's right, 20% of California companies are accruing a large tax credit right now.

How large?

A company paying for employee's individual/family plans or even "allotting" money for that type of coverage is potentially liable for:

a penalty of $100/day per employee; up to $36,000 per year.

They went further and clarified that the penalty even applies to small companies down to 1 employee and even if it's "packaged" in a Section 105, which have been sold to many companies as a way to keep the IRS at bay.

Good news is that with tax credits, we may be able to avoid the huge penalty while still reducing costs significantly.

Contact us immediately at help@calhealth.net or at 866-696-8636 if you have under 25 employees and the average salary (not including owners/officers) is under $50K.

Rippling

- Online Cloud-Based HR System

Rippling

- Online Cloud-Based HR System

We're very excited about this option. Our head group leader put it succinctly...

"It's a game changer".

He is not a person prone to exaggeration so we took note.

WIth our new Rippling offering, we are offering our clients a revolutionary, cloud-based benefits and HR management tool completely integrated to payroll!

Here's what you can expect:

Online tools for onboarding, offboarding, and benefit management

Simple and intuitive HR management suite including compliance suites

Direct integration with payroll (and many more system!)

All in one, clean interface.

It really pretty amazing.

What can you expect from the system (besides our guidance in how to use it)?

Expect a 50% decrease in time and energy spent managing HR changes and issues.

This is perfect for companies that find themselves stretched on the HR side of things.

If you're wearing the HR hat at your company, it will make your life so much easier and at the same time, make you look like a rockstar to the employees that rely on you.

It's that good.

Again, we offer this tool to all our group clients at no cost.

We pick up the cost for one reason...you'll love the system so much, you'll never leave us.

We put our money where our mouth is.

Contact us regarding the Rippling option and we can take you for an online demo at help@calhealth.net or call 866-696-8636

Private

California Exchange

Private

California Exchange

Most employers are unaware that there is a Private Exchange option available in California.

This can offer many ways to save on health insurance including the following:

- Mix and match carriers such as Kaiser, Blue Shield, Health Net etc to your employees.

- Define a contribution amount or percentage towards our employees premium

- Take advantage of Employee Solutions for additional savings

This is really one of the best options on the market that most companies are completely unaware of.

Many companies that we discuss the Private Exchange with have NEVER been quoted this option by existing agents.

We find that to be very interesting since many of their existing plans are available through Covered Ca with lower pricing and a host of add-ons.

We can quickly quote this option (called California Choice) for your company at no cost to you.

For certain carriers and plans, Cal Choice's pricing is pretty phenomenal.

Let us see if we can use this Private Exchange to reduce your cost.

Also, if you have some employees that want Kaiser while others want a PPO with another carrier (to keep doctors), Cal Choice is the perfect option.

Request your free quote for Cal Choice group health benefits here.

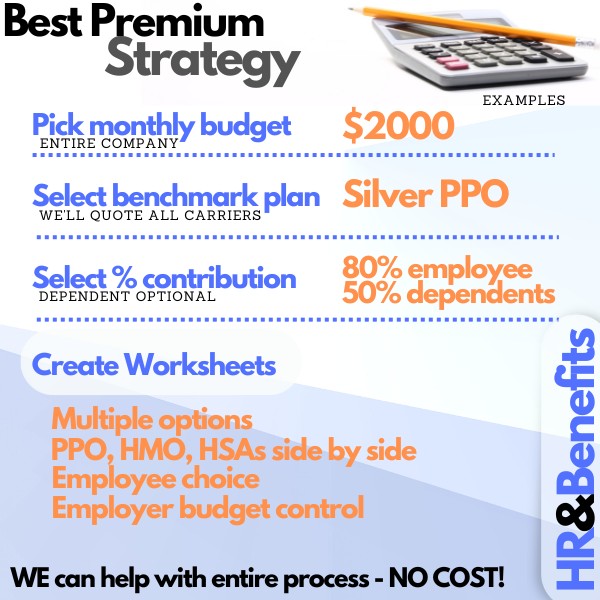

Defined

Contribution with Major Carriers

Defined

Contribution with Major Carriers

This really is a hidden gem.

Here's the basic premise:

- You define an amount that you will pay per month for each employee and/or dependents. It can either be an amount or a percentage; even a percentage towards a given plan.

- You lock in your budget and the employee has complete choice across a range of options.

Here's the secret behind why it works to keep costs down!

There's a built-in incentive for employees to reduce the plan coverage and cost to fit their budgets.

You're not telling them to do it. They are CHOOSING to do it.

We found that most employees will choose a higher deductible to reduce their share. Employees with more health issues will go up the scale but according to what works best for them.

Net effect:

- the overall cost to the employer goes down.

- Employees are happy because they have control.

- Win win.

POP 125 Tax Savings

If your employees are contributing anything towards their costs or their dependent premium, you MUST have a POP 125.

This allows two kinds of savings:

- Employee pays their part with pre-tax money

- Employer reduces employee tax on same amount

If you have employees that pay part of their (or their dependent) premium, and do not have a POP 125, it's akin to throwing money away.

Actually, throwing money to the IRS.

We can easily set this up for your company and look at other similar options to bring down your cost while providing the same if not better benefits.

Ask us about the POP 125 at help@calhealth.net or call call 866-696-8636

Minimum

Essential Benefit Plans

Minimum

Essential Benefit Plans

Many larger companies (over 50 full time equivalents or 150 labor hours per week) are potentially facing a large penalty for not offering group health insurance due to the new law.

The penalty is accruing right now!

There are new plans which may be far less expensive that either the penalty ($2-3K per employee annually) or the standard ACA compliant plans.

We can help you evaluate if this option will work for you company.

There are a few options there.

We can either look a placeholder plan at the lowest cost to avoid the biggest penalty.

We can also look at a Minimum Essential Benefit plan which meets the full ACA requirement but is priced better than most Bronze group plans on the market.

Either way, it's worth looking at if you are a larger company and do not offer benefits. Call us at 866-696-8636 or email help@calhealth.net

ACA Renewal Proposal Overview

Finally (and most importantly), why not get a free bid on all the options above to make sure you have the best coverage at the best rate.

There's no cost for our services

We'll quickly turn around all these options for your company

30 years combined experience in the group health market

Call us at 866-696-8636 or enter your basic census info so we can get started.

Related Page: Small Business Tax Credits through Covered California