California Medicare Options - United Health AARP versus SCAN Advantage Plans Comparison

SCAN vs. UnitedHealth (AARP) Medicare Advantage Plans in California: Compare and Review

This is quickly becoming the main match in most areas for California Advantage plans.

Very different companies...almost polar opposites.

On one hand, we have one of the biggest nationwide health carriers with United Health and it's marketed by THE biggest non-profit out there...AARP!

On the other hand, you have a small non-profit that started in Long Beach and has quickly raced to #3 in California for Advantage plans among giants by doing everything right.

Again, when we run quotes in the greater Los Angeles area, they're generally speckled throughout the top 10!

Why? We'll get into all of this and more importantly, look at a key difference to zero in on when comparing SCAN and United Health.

First, our credentials!:

Here are the topics we'll cover:

- A quick intro to the contenders, SCAN and United Health (AARP)

- How to

compare SCAN and United Health

- What is SCANs advantage

- What is

United's advantage

- SNP plans and SCAN versus United

- Quoting SCAN and

United side by side

- How to enroll in SCAN or United Health

Let's get started. Ding Ding Ding! "In this corner..."

A quick intro to the contenders, SCAN and United Health (AARP)

We have deeper dives on SCAN advantage plans or United Health (AARP) advantage plans.

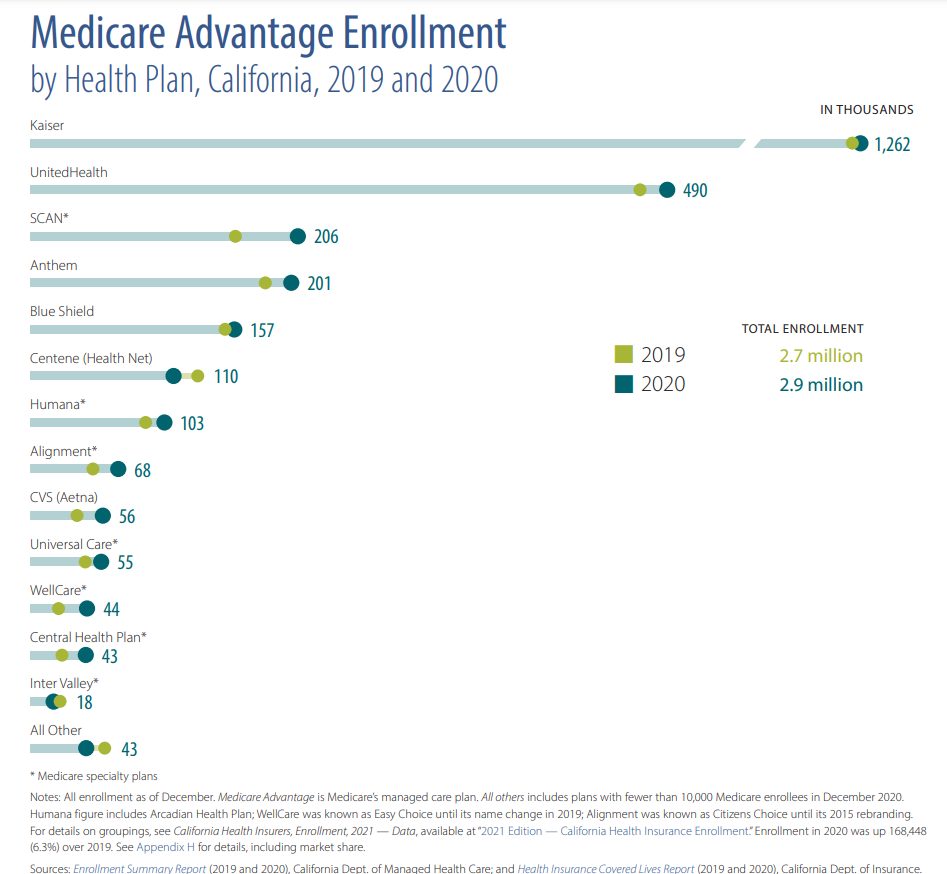

First, let's size up the total market to see where they sit in California's advantage enrollment:

So, first, you have Kaiser, which makes sense considering their pre-65 enrollment.

Then, you have United Health followed by SCAN.

Look right below SCAN. There's Anthem, Blue Shield, Health Net, Humana, and Aetna!

Monster players with nationwide reach. Anthem, Shield, and Health Net are in every market segment in California with the Blues being the original OGs for coverage (along with Kaiser).

Somehow, SCAN has managed to capture this market ahead of them!

A few notes.

United Health is the carrier and AARP is the marketing arm. When you shop for "AARP" senior plans, the coverage is ultimately offered by United Health.

We'll use them interchangeably! They've had this agreement for years now and it's a big reason why United is #1 outside of Kaiser.

That isn't to knock United...they're a solid carrier but it speaks to the "rising tide" that lifts United Health. When Aetna had the AARP relationship many moons ago, they were the dominant player in senior plans (then supplements).

That's another big difference. SCAN only participates in the Advantage market currently.

United offers Advantage AND Medicare supplements (learn how to compare Advantage and supplements).

Advantage plans are HMOs so they require lots of people to make them work correctly (more from our Insider's Guide to Advantage or how to compare Advantage plans).

You can see that United and SCAN both hit that threshold with 100's of 1000's of members.

So...how do we actually compare them in your area?

How to compare SCAN and United Health

First, each area will be different. Different plan options and even different Star Ratings (more below).

It's important to run your personalized quote here:

It's fast, free, and instant!

You'll then get the full quote for your area and you can see SCAN and United Health (AARP) on one page. If SCAN doesn't show in your area, email us at help@calhealth.net and we'll run the quote separately for you.

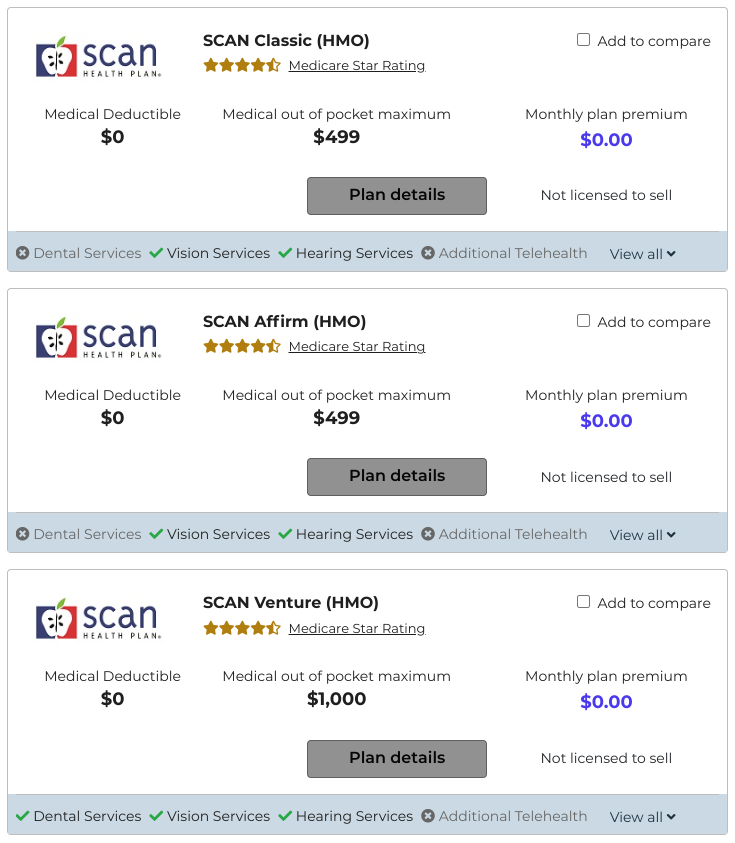

Here's an example from Los Angeles with SCAN and United Health filtered on the left:

The system reflects what Medicare's quote system would show in terms

of plan order which looks at monthly cost, total cost, and star rating.

A few notes for the biggest Advantage market in California:

- SCAN has the first 3 spots with zero premium, star ratings of 4.5, and

max out of pockets under $1000

- United has the next spots with zero premium, star ratings of 4, and max's under $1000

Goodness...they're running it in the biggest market (by far) outside of Kaiser.

If you've read any of our other guides (how to pick the best advantage plan) this all makes sense according to our Triple Threat criteria:

- Low or no monthly premium

- Max out of pockets under $1000

- Star Rating of 4 or higher

That's the secret sauce and it's how you avoid the bad Advantage plans!

Go figure that the top 6 plans from these two carriers hit all our hallmarks of a good Advantage plan.

Since they're so comparable, how do we compare them for our situation?

First, the Star Rating is a big deal although both are high.

- The Classic plan is SCAN core advantage plan offering.

- Affirm is new

offering geared for the LGTBQ+ market

- Venture gives a rebate back for Part B premium (became popular during covid)

4.5 is better than 4; all things being equal.

First, SCAN's offering

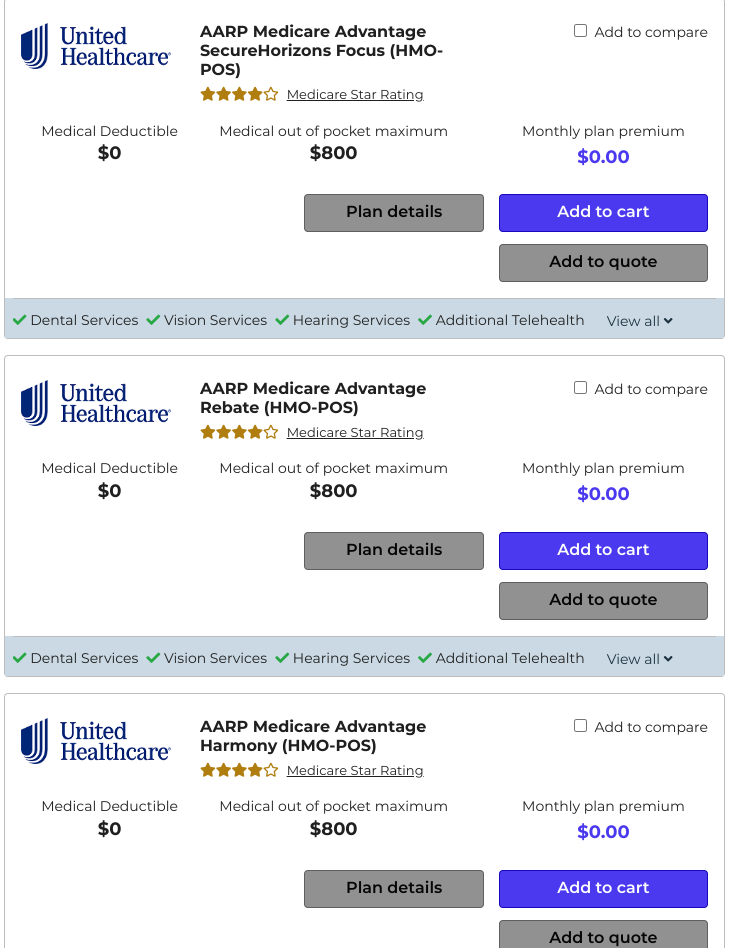

For United:

- SecuredHorizons is the branding for a massive Advantage plan group that United bought from Pacificare. It was the leader back in the day and many people remain there as they like the plans.

- The Rebate option is United's foray into giving back Part B premium.

- Harmony is the core advantage plan that meets our triple threat so we're not surprised it rounds out the top 3.

Okay, we have the core vitals (Star rating, premium, out-of-pocket max).

Are there broader questions we need to look at when comparing SCAN and AARP plans?

What is SCANs advantage?

SCAN is really fascinating as a company (non-profit).

They are really doing everything well in terms of the original mission of Advantage plans.

If you can make people healthier, it will bend the cost curve.

That was the promise! Now, many plans have fallen short but SCAN appears to be delivering and that's why a small company out of nowhere is racing ahead of giants.

It's the little things.

For example, partnering with Sortapouch which can organize meds by day/time of day in little pouches so seniors don't make mistakes on medications. Very common and with serious health (and cost!!) ramifications.

Or the ride card you get along with your ID card. Keeping doctor's appointments is also key to avoiding bigger issues.

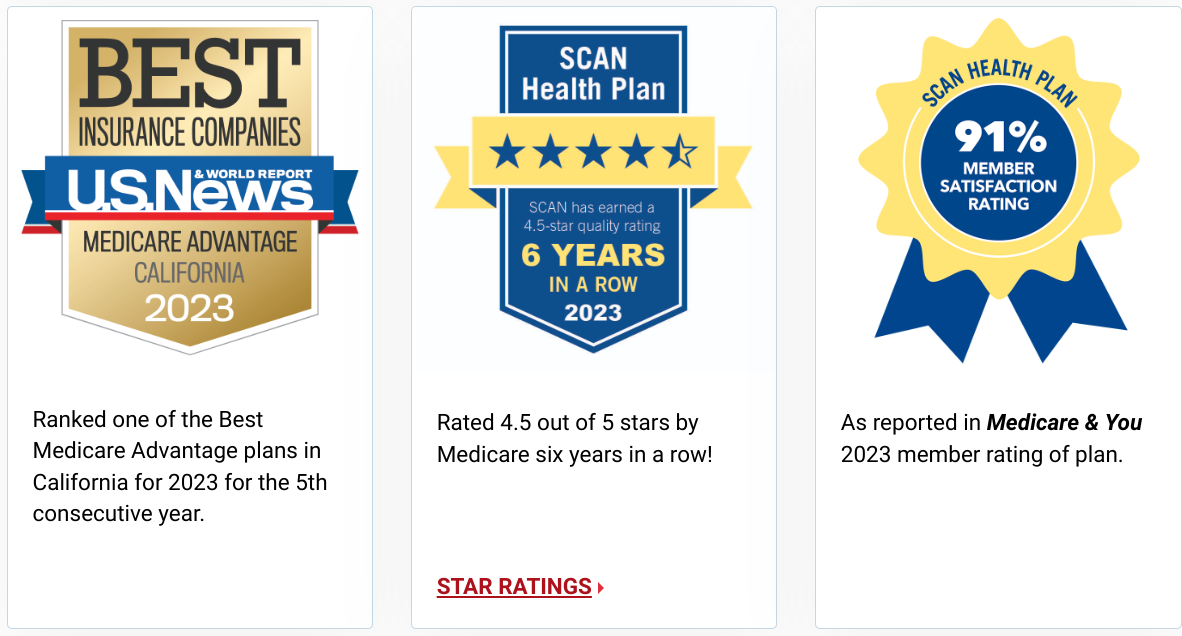

It's a slew of little things like this that make SCAN very impressive and apparently, their enrollees approve:

4.5 is really a high mark on the market. One of the best!

The 91% member satisfaction rating is also a coup and most carriers don't advertise their numbers since they don't really support the marketing message!

If they're available in your area (run quote here) and the plans meet the Triple Threat selection criteria, SCAN is definitely a key consideration. We'll add the final piece to the equation below.

What about United?

What is United's advantage?

In our LA example, United's also hitting all the criteria of our Triple Threat selection:

- Zero premium

- Max out of pocket under $1000

- 4 Star Rating average

So...what is United's advantage besides friends in high places (AARP)?

It's the provider network.

They have the largest provider network for Advantage plans and this is a big deal especially with Advantage plans.

After all, we're describing HMO plans and by definition, you have to stay in the network outside of a true emergency.

For people who want the biggest network, United becomes a dominant force.

We gave the example above just to make a point. Having UCLA and Cedars is really a coup for United. Those are two of the best hospitals networks in the State and even the country! It speaks to their depth of network and remember...network is one of the things we're giving up with HMO Advantage plans so...

How do we address this?

Run your quote and make sure to enter your doctors AND your medications.

Our free system will automatically take this info into account when it shows the plans and you'll be able to see if your doctor is in the network for SCAN and/or United Health.

This may be the deciding factor between the two due to United's expansive network.

It's also a reason for both carriers since size of the carrier directly drives the size of networks with HMOs and both carriers have the biggest enrollment outside of Kaiser (which is its own network).

So run the quote and enter doctor's info when the email arrives!

Reach out to us with any questions! This is just an example with Los Angeles. Make sure to check your area and situation since very area is different.

One more quick difference between the two.

SNP plans and SCAN versus United

There's a class of plans called SNPs (Special Need Plans).

The two biggest categories are:

- D-SNPs - Dual eligible or people who have both Medi-Cal and Medicare

- C-SNPs - People with chronic illnesses

SCAN has plans that meet these criteria and they can offer richer benefits to their eligible members.

Let us know by email at help@calhealth.net if you might meet these criteria and we can send a quote specific to that or at least highlight the plans among all of them. You can also select "Show SNP plans" through the quote above!

United Health does not focus as strongly on the SNP plan offerings currently (may change year to year so check with us) so this may be a factor.

So...how to quote the plans for your situation (age and area will affect options!)

Quoting SCAN and United side by side

We make this as painless as possible and there's zero cost for our assistance or quoting system.

First, run your quote here:

- You'll be able to enter your doctor and RX information

- You'll get the full quote with top carriers in your carriers; if

SCAN doesn't show, email us at

help@calhealth.net

- You can filter for SCAN and/or United Health plans on the left to see their offering

That's it! Now focus on:

- Star Rating of 4 or higher

- Low or no monthly premium (may not be

available in all areas)

- Lowest max out of pocket

We explain why a max of a few $1000 doesn't make sense when comparing a G plan supplement at our Trade-off between Advantage and Supplements.

Careful, lots of brokers and carriers pushing bells and whistles for plans with really nasty back ends if get sick or hurt! We looked at what to watch out for with our What's Wrong with Advantage Plans or how to find a good Medicare Advantage broker.

That's not our thing:

Reach out with any questions at this point at help@calhealth.net (we can schedule a time to walk through questions!)

This stuff is confusing...bounce any and all questions off of us!

What about enrollment?

How to enroll in SCAN or United Health

This is where we're really excited.

Just "Add to Cart" through the quote above and the online enrollment is free, fast, and secure.

At annual open enrollment, you just update your info and you can quickly quote and/or change plans!

Saves so much time and frustration since most of your info is already there (securely).

Zero cost for access to this system or our help!

We'll make it easy! That's our job after all.

In the meantime, reach out with any questions at

help@calhealth.net or

(888) 496-9439

Important Disclaimers:

- We do not offer every plan available in your area. The number of organizations and plans available will be specified for your specific quote here. Please contact Medicare. gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

- Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations, exclusions, copays, deductibles, and coinsurance may apply.

- Part B Premium give-back is not available with all plans. Availability varies by carrier and location. Actual Part B premium reduction varies.

- Every year, Medicare evaluates plans based on a 5-star rating system.

- Not affiliated with or endorsed by the government or Federal Medicare Program. Goodacre Insurance Services is an insurance agency not affiliated with the government.