Medicare Plans in California -

The Anthem Senior Smart Choice and its replacements

Medicare Plans in California -

The Anthem Senior Smart Choice and its replacements

The Anthem Senior Smart Choice Plan

The Smart Choice Medicare Supplement was pretty groundbreaking back in the day.

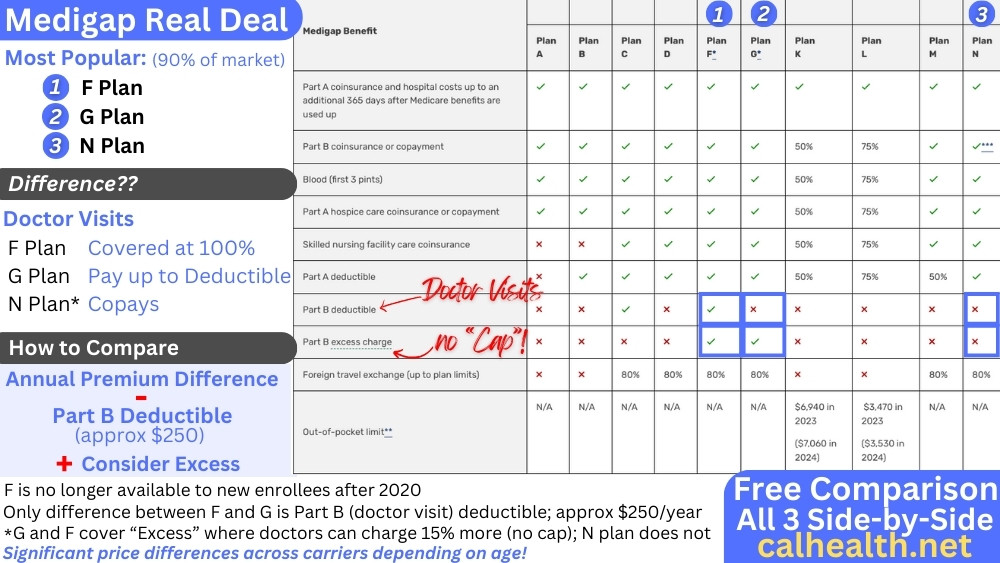

Basically, apply a high deductible (separate from the Medicare deductibles) to an F plan to significantly reduce the monthly premium but still keep the "cap" in case of big bills.

It made a lot of sense for many of our clients who were coming off of high deductible plans anyway and the premium difference over a year's time almost offset the difference in deductible originally.

The Senior Smart Choice is no longer available to new enrollees although some people still remain on it (for years now).

There's a whole new crop of plans that accomplish the same high deductible need but perhaps, with better pricing!

Check out the new suite of G high deductible plans. The G plan is the same as the old F plan (no longer avaialble) except you have to pay the Part B deductible (roughly $150/annually now) but that fits our original aim with the Senior Smart Choice anyway (add deductible for savings).

Interestingly, since the Senior Smart Choice is a "closed" book (can no longer add new members), it's become more expensive relative to the competition over the years.

Run your G plan high deductible quote across the carriers to make sure you're not paying too much:

Again...the G plan covers Excess just like the old F plan (and Senior

Smart Choice) and we go into why this is so important at our

Medicare Excess Review.

It's a free service we provide to all our Medicare supplement clients.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact www.medicare.gov or 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 day a week to get information on all of your options.